Pre-investment due diligence

During the year to end December 2024 we screened 653 opportunities equating to $240bn of opportunities across all our products, and invested $6.8bn (c.3%), with every prospective investment evaluated by the ESG team.

This approach enhances our understanding and mitigation of broader risk in an investment context and identifies investments needing more in-depth analysis or post-investment monitoring and disclosure.

Our pre-investment due diligence continues to evolve on a risk-driven basis with proven elements maintained during 2024 and new initiatives piloted for adoption, including technology-enabled solutions. Some of these enhancements have been driven by the need to implement our ESG Policy across new products and others by regulatory developments such as the EU-Sustainable Finance Disclosures Regulation (or ‘SFDR’, notably in the context of Article 8 and EU-SFDR).

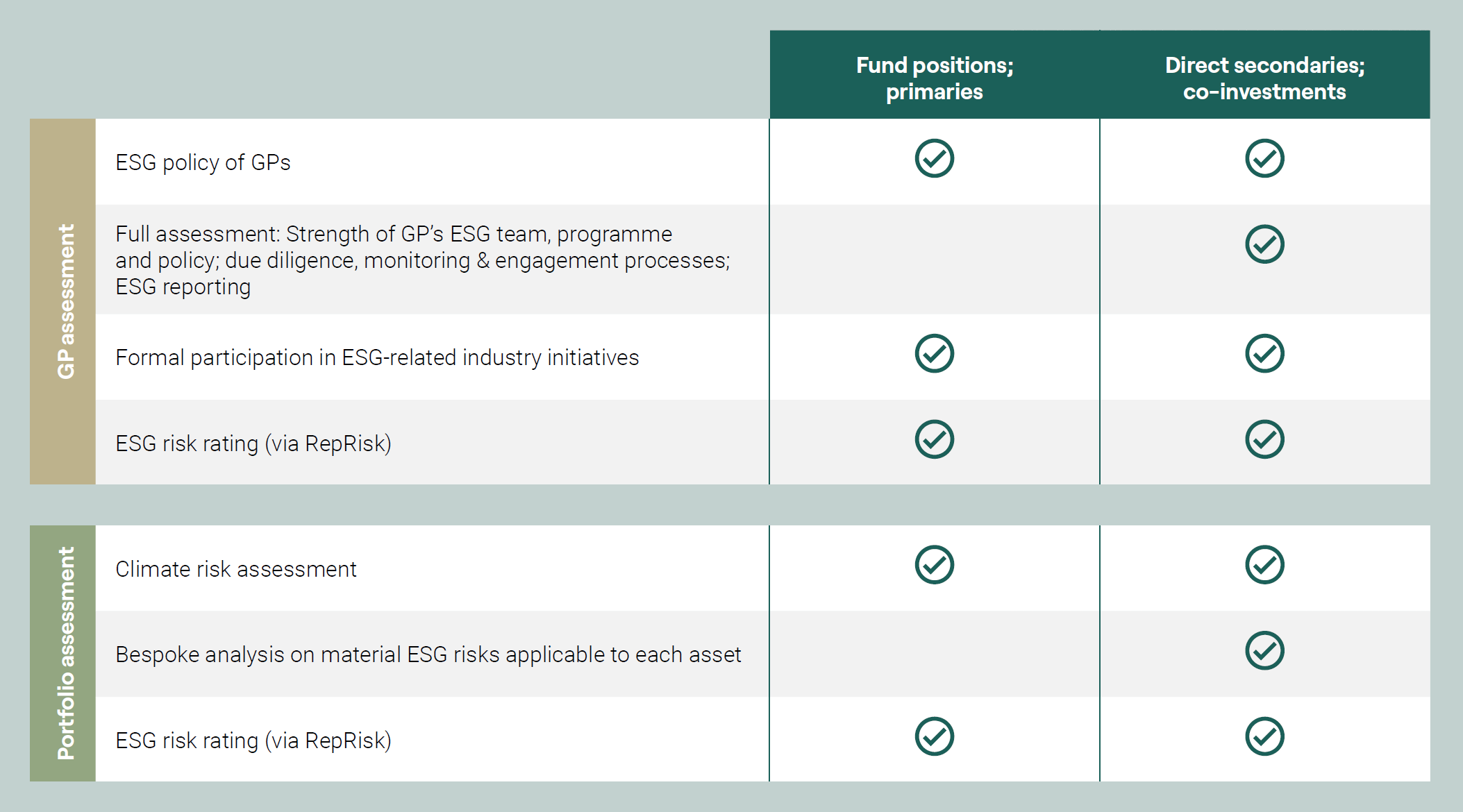

Fund positions and primaries vs. direct and co-investments