By the numbers

ESG driving value creation in PE

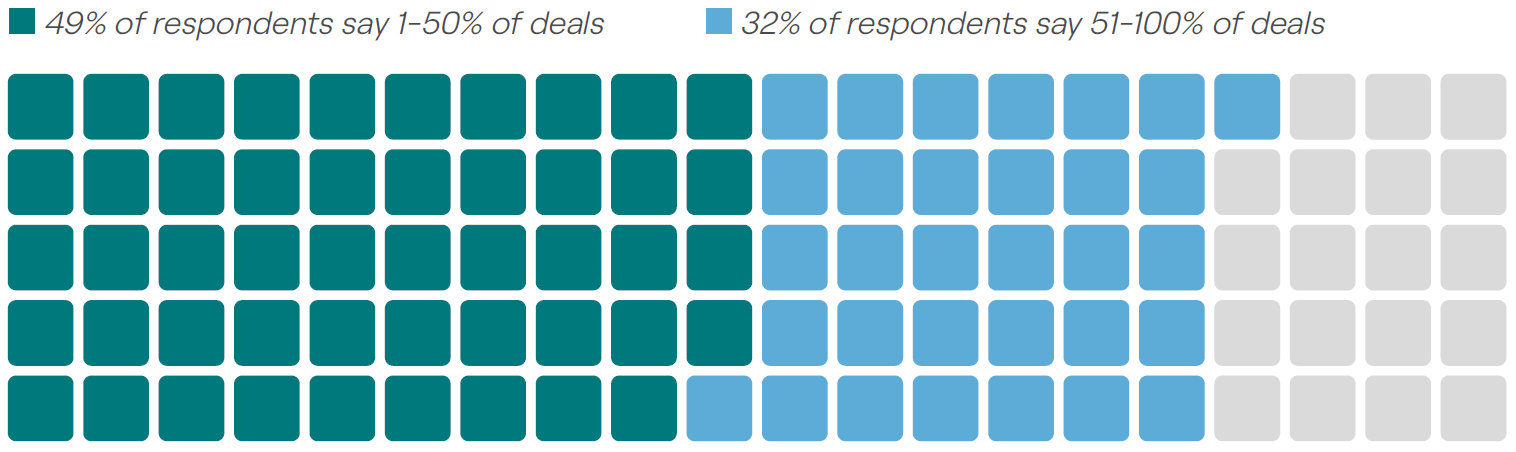

Of the deals that your firm/fund completed during the past 12 months, what proportion included ESG as one of the primary drivers of value creation?

Source: PwC’s Global Private Equity Responsible Investment Survey 2023 (base: all respondents = 166)

GPs are using environmental, social and governance (ESG) factors as major drivers for value creation, according to PwC’s Global Private Equity Responsible Investment Survey 2023. A third of respondents said that more than half of their recent deals featured ESG as a primary value creation lever, while 49% said the same of up to half of their recent deals.

Value creation from ESG is rising. The survey found that 70% of respondents said value creation was a top-three driver for ESG activity within their firm, up from 66% in 2020. And 37% ranked value creation in top position, compared with 29% in 2020.

| 7% | The percentage of sponsor-backed exits via GP-led secondary deals in 2022, according to Jefferies’ Global Secondary Market Review, January 2024. |

| . | |

| 12% | The percentage of sponsor-backed exits via GP-led secondary deals in 2023, according to the same Jefferies report. This reflects the growing popularity of GP-leds to offer LPs a liquidity option as other exit routes proved hard to come by last year. |

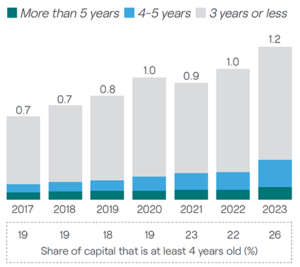

Buyout fund dry powder is ageing

Global buyout dry powder, by years since capital raised (US$trn)

|

The slow deal-making environment in 2023 has had a significant impact on how long GPs have held on to dry powder since raising capital, according to Bain & Company’s Global Private Equity Report 2024. Of the record US$1.2trn of uninvested capital that GPs had at their disposal in Q2 2023, 26% had been raised four or more years previously, up from 22% a year earlier and from 19% five years earlier. |

| With the average buyout investment period set at five years, many GPs will therefore be under pressure to deploy ageing capital over the coming year, with some potentially facing LP requests to be released from their remaining commitments. | |

Source: Bain & Company, Global Private Equity Report 2024.

Notes: Buyout category includes buyout, balanced, co-investment, and co-investment multimanager funds; assumes average investment period of five years; percentage split of capital raised in 2023 is as of Q2; discrepancies in bar heights displaying the same value are due to rounding differences.

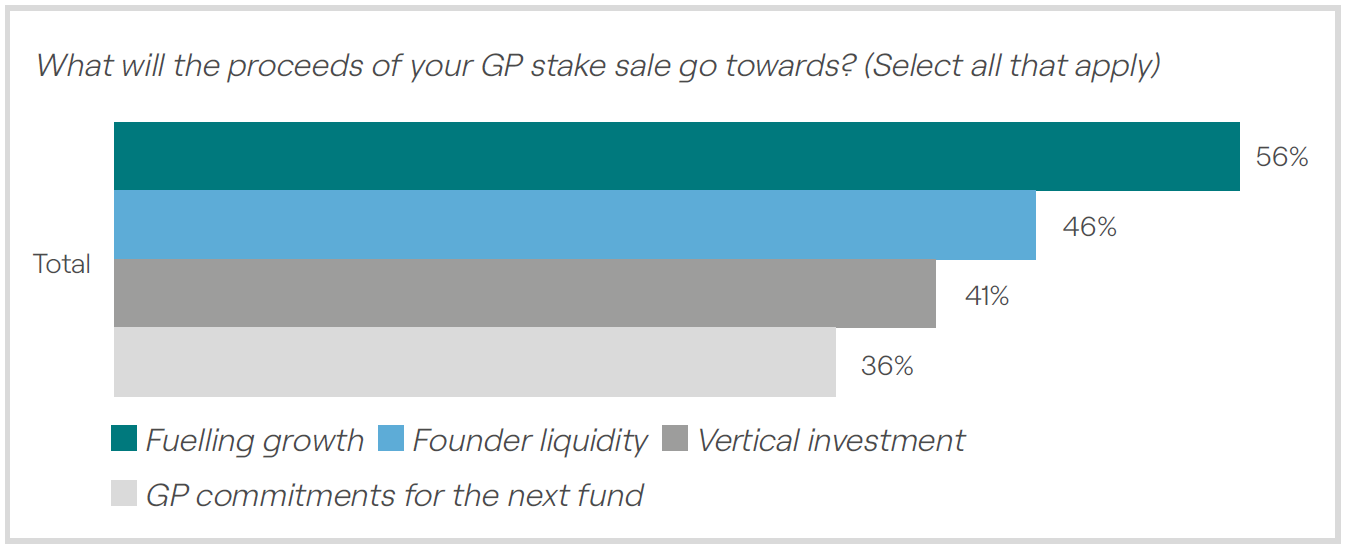

GPs eye stake sales

The trend for GPs to sell a stake in their management company shows no sign of abating: 59% of firms surveyed for Dechert’s 2024 Global Private Equity Outlook said they were planning a sale in the next two years.

When asked what they would use the proceeds for, the firm’s growth was the top response at 56%, followed by founder liquidity at 46%. Yet there is some variance by region. While 70% of European, Middle East and African GPs, and 59% of their US counterparts,

plan to use the capital they raise for growth, just 20% of Asia-Pacific respondents say this.

Instead, the top responses for Asia-Pacific GPs were vertical investment and GP commitments, both cited by 60%. This, says the report, is because liquidity in the Asian PE market has been relatively scarce, making it more of a challenge for GPs to meet their personal fund commitments.

Source: Dechert, 2024 Global Private Equity Outlook.

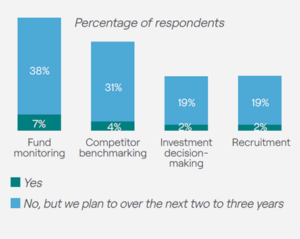

LP use of AI to rise

AI integration across process – LPs’ views

| The integration of artificial intelligence (AI) among LPs is low, with just 7% of respondents to Coller Capital’s Global Private Equity Barometer, Winter 2023-24 saying they use it for fund monitoring and 2% for investment decision-making.

Yet this is set to change in the next three years, with 38% planning to implement AI technology for fund monitoring, 31% for competitor benchmarking and 19% for investment decision-making and recruitment. European LPs are more likely than those in other regions to deploy AI technologies across the range of processes. |

|

Source: Coller Capital, Global Private Equity Barometer, Winter 2023-24

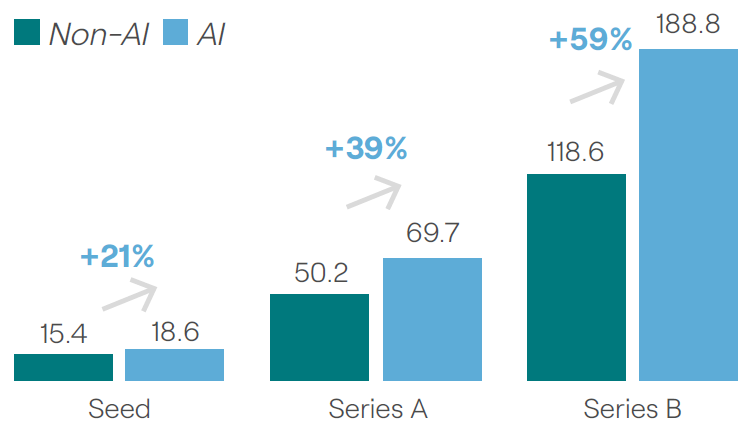

AI-related start-ups see elevated valuations

Median valuations for VC-backed deals in 2023 ($m)

Recent advances in artificial intelligence (AI) are leading to an investor scramble to get stakes in the next big technological disruption. Seed-stage AI-related companies commanded a 21% premium over their non-AI peers last year, according to analysis by CB Insights. Later stages registered even more of a difference – valuations for Series A AI companies were 39% higher and for Series B, a massive 59% higher.

Last year, VC investment in AI start-ups fell to its lowest level since 2017, suggesting a focus on high-quality companies, says CB Insights. High corporate interest in the sector is the main factor pushing up AI valuations, with many of the largest technology companies investing heavily.

Source: CB Insights valuation data. Compares the valuations of AI vs. non-AI companies in 2023.