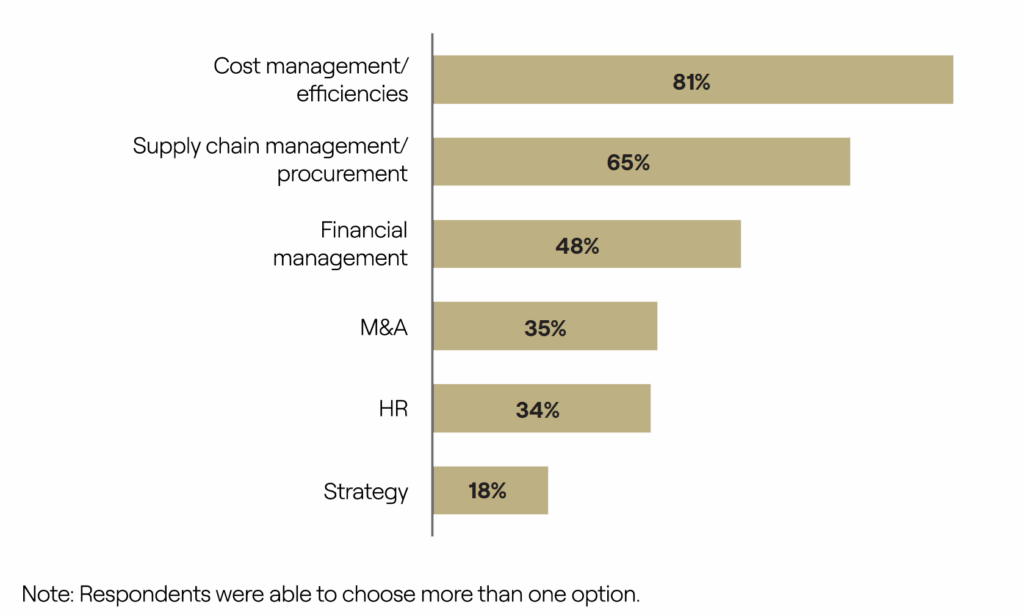

GPs harness AI as a tool for cost management in portfolio value creation

Cost management and efficiencies was the top area where GPs are using artificial intelligence (AI) to add value to portfolio companies, according to investors. This suggests managers are focusing on the near-term and tangible value creation potential AI can bring in streamlining internal processes, enhancing productivity and optimising resource allocation. This view is most prominent among North American investors, with 90% saying this.

Supply chain management and financial management emerged as the next most common areas of AI deployment. This indicates that GPs are using AI in functions that directly support internal controls and have a clear bottom-line impact.

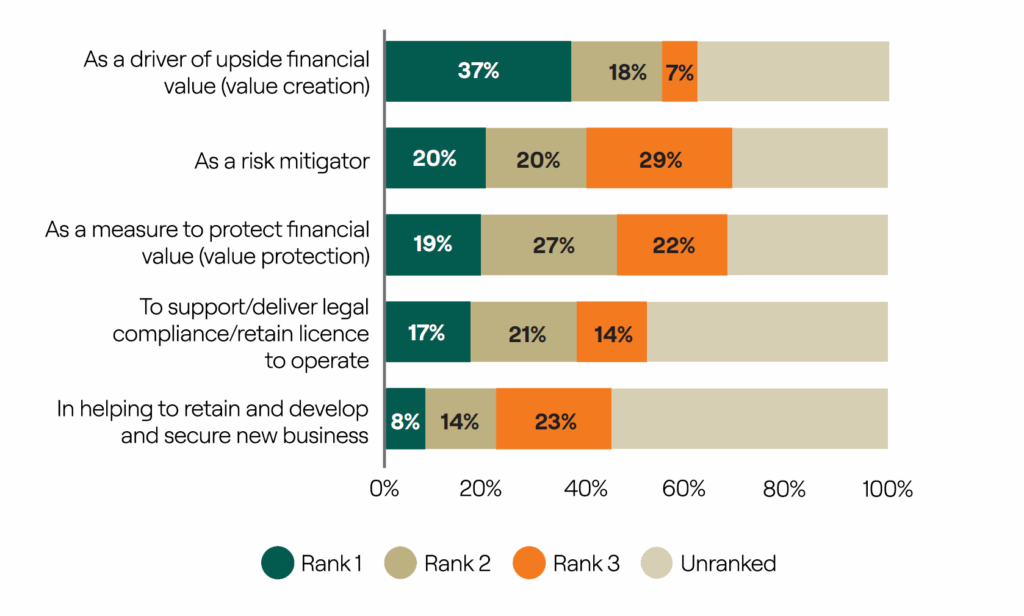

ESG factors are no longer just a compliance item; they are now a major consideration for private market investors. The rankings suggest that most respondents believe ESG and sustainability is a proactive lever for value creation and reflects a growing confidence among GPs that strong ESG performance can create upside financial value and competitive advantage. While value creation was ranked highest, risk mitigation received the largest overall vote count, followed by financial value protection. This underscores how crucial investors believe ESG to be for both value preservation and creation.

LP views on new investment and exit prospects in the next 12 months show some divergence by region. In Europe and APAC, around half of respondents believe the environment for both will be neutral, versus just a quarter in North America. However, around a third of APAC LPs surveyed are pessimistic about new deals and exits, while only around a tenth are optimistic. The picture is a little more balanced in Europe, while North American respondents are far more likely to be optimistic than pessimistic: nearly half believe the new deal and exit environment will be positive in the coming year.