Corporate and commercial credit – the most compelling private credit investment opportunity among the options presented

Private credit has continued to expand and evolve rapidly as an asset class in recent years, attracting strong investor interest. Against this backdrop, a majority of LPs (59%) see corporate and commercial finance as the most compelling opportunity in private credit in the next three-to-five years among the options presented. Demand for non-bank lending remains relatively strong in this segment, particularly among mid-sized companies navigating refinancing needs or growth initiatives. These are also often senior secured positions, offering yield and downside protection.

On the other hand, areas such as consumer finance, project finance or real estate hold less appeal for investors. Consumer finance is typically characterised by higher credit risk and shorter durations, making it more sensitive than others to broader macroeconomic shifts and market volatility. Infrastructure and real estate typically involve more regulatory complexity and long-dated capital commitments, factors that can weigh in on liquidity and increase execution risk, especially during market downturns.

Reflecting the growing appetite from LPs and GPs for active portfolio management, our Barometer highlights that investors believe credit secondary market growth is set to continue, driven by sponsor-led transactions and continuation vehicles. The maturity of the private credit market is driving a deeper, more sophisticated private credit landscape.

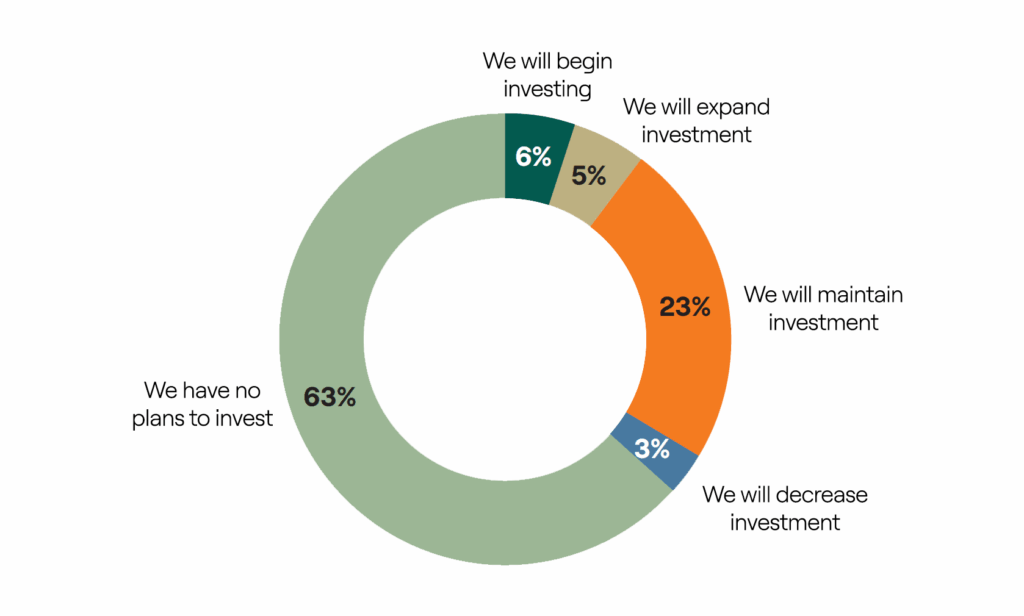

Current macroeconomic unpredictability is likely to be dampening appetite for risk-heavy strategies, which may help explain why distressed debt is a low priority for 66% of investors. Despite this, over a fifth of respondents will maintain investment in the strategy over the next two-to-three years and a further 11% plan to expand or begin investing. This signals some appetite for the potentially high returns distressed strategies can deliver.

Some of the shift away from distressed strategies can also be attributed to investors turning their attention to special situation strategies, which – despite some overlap – tend to offer a broader opportunity set.

We found that 65% of investors expect an increase in the volume of private credit GP-leds in the next two-to-three years. Testament to the fact that as private credit continues its robust growth trajectory, investor interest in secondaries within the asset class is also rising. As more private credit funds approach the mid-to-late stages of their lifecycle, sponsors can tap into CVs or other GP-led structures to retain assets while providing liquidity.

00:00:06 – 00:00:13

As private credit continues this robust growth trajectory, investor interest in...

00:00:06 – 00:00:13

As private credit continues this robust growth trajectory, investor interest in private credit secondaries is also rising.

00:00:13 – 00:00:19

In this issue of the Barometer, we asked LPs about their views on GP led transactions in the private credit space.

00:00:20 – 00:00:27

65% of LPs surveyed expect an increase in private credit GP-leds over the next 2 to 3 years.

00:00:28 – 00:00:41

As more private credit funds reach the mid to late stages of their life cycles, GPs can make use of continuation vehicles or other GP led structures to provide liquidity to the investors and additional runway for their existing assets.

00:00:42 – 00:00:47

For more details on these findings, find the full report on our website