Evergreens continue to attract attention from early adopters

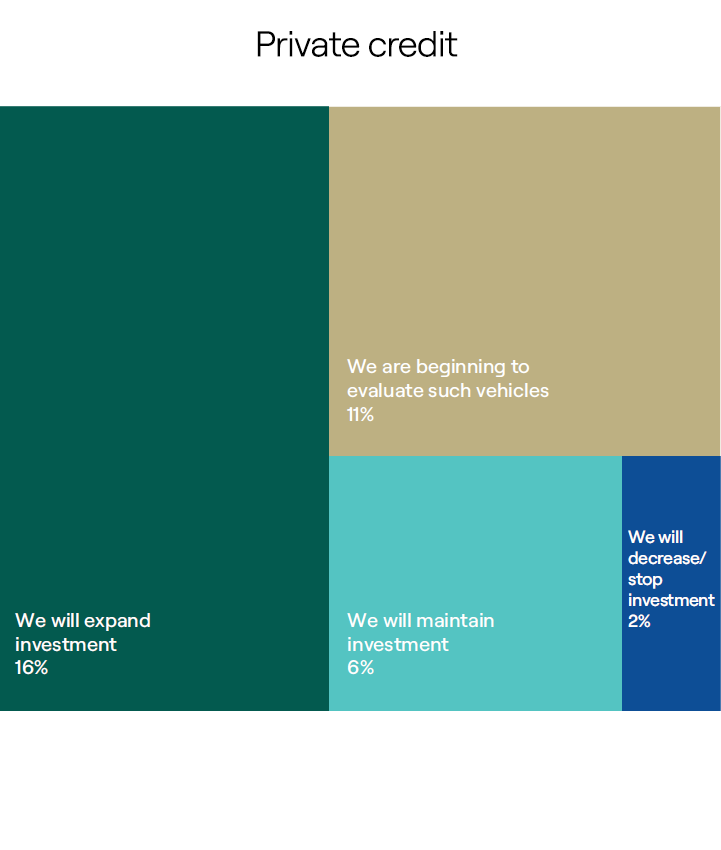

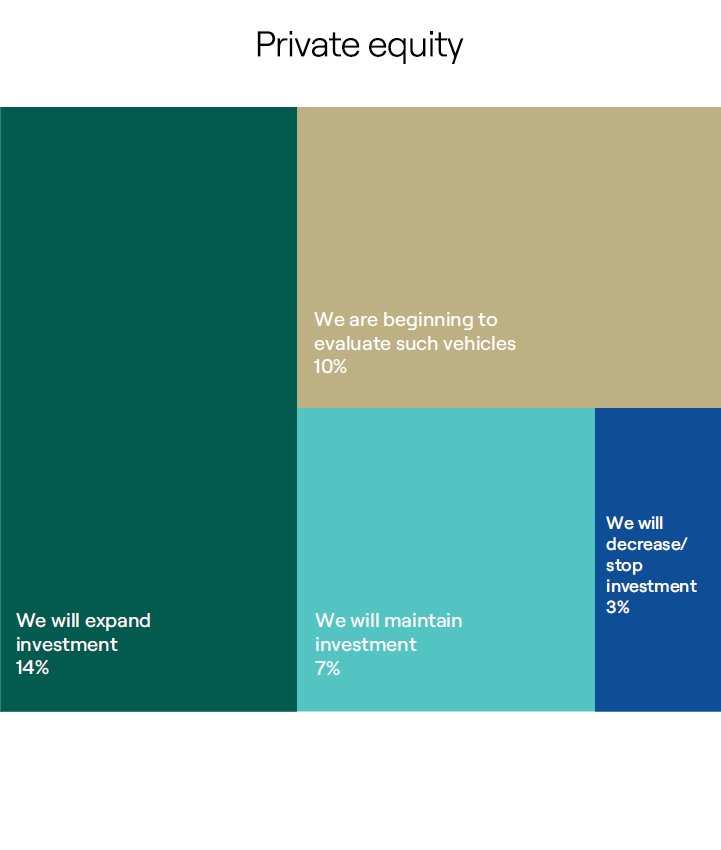

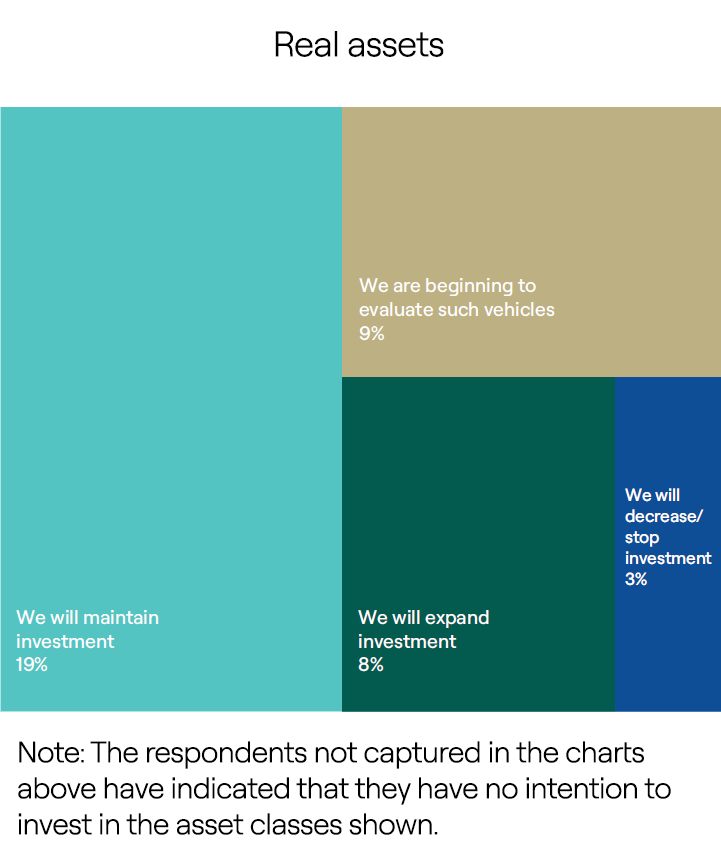

In our Summer 2024 Barometer, 21% of respondents had already invested in semi-liquid funds or planned to do so in the near future. A year later, interest has increased as the number of vehicles has risen: a average of 33% of respondents have invested or are planning to invest in private equity, private credit and real assets evergreen funds. Private credit in particular is emerging as the asset class where LPs are most keen to evaluate or expand evergreen exposure, with 27% indicating this.

|

|

|

|

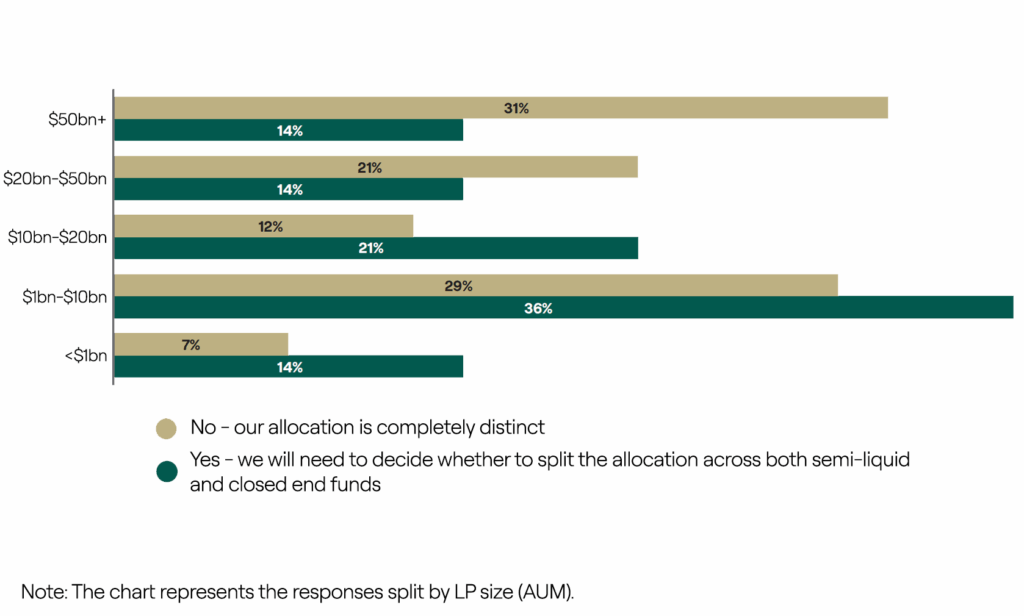

Additionally, over two-thirds (71%) of LPs say that their allocation policies for closed-end funds and perpetual vehicles are entirely distinct. This underscores the structural and strategic differences between the two and the separate roles they might occupy within the portfolio.

Over a quarter (29%) of investors, however, expect to face a decision between allocating to closed- end funds or evergreens when considering their alternatives exposures. This is most pronounced among APAC investors and indicative of regional differences in liquidity preference or portfolio flexibility, although this may shift as private capital investment options evolve further.