Among LPs who expressed a view – continuation vehicles deliver above or in line with initial expectations for most

Now a well-established part of the secondaries market, continuation vehicles (CVs) have grown rapidly in recent years. As both a liquidity solution and an exit route, they offer a range of benefits for both GPs and LPs. As LPs have come to understand these structures better, alignment with GPs has improved, with sponsors now frequently reinvesting substantial capital alongside rolling investors. As CVs mature and gain popularity, attention is naturally turning towards their performance.

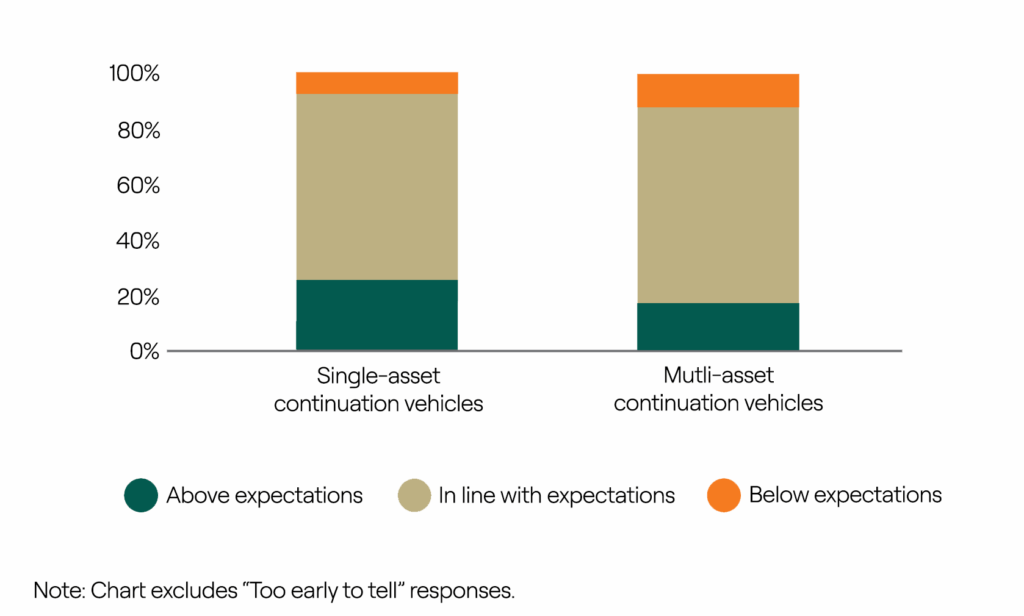

We asked LPs how the CVs they have backed are performing relative to initial expectations. For many respondents, it is understandably too early to tell. However, among those who did express a view, most indicated that CVs have performed either in line with or above expectations. Specifically, 47% of LPs said single-asset continuation vehicles met or exceeded expectations, whilst on the multi-asset front that figure stood at 36%.

Greater understanding of CVs within the broader asset lifecycle is helping LPs become more discerning in their evaluation of these vehicles. These transactions often come at a time of operational momentum for the asset(s) and CVs provide additional time for future growth and the potential for greater upside.

00:00:06 – 00:00:13

Continuation vehicles have become a well-established part of the private market...

00:00:06 – 00:00:13

Continuation vehicles have become a well-established part of the private market landscape.

00:00:13 – 00:00:20

They play an important role as an exit route, but also as an attractive investment opportunity.

00:00:21 – 00:00:27

While it’s early days in this asset class, we are starting to see positive trends in performance.

00:00:28 – 00:00:37

In this edition of the Barometer, we asked LPs, how are the investments in continuation vehicles performing against the expectations.

00:00:38 – 00:00:50

While many say it’s too early to tell, 47% of LPs say, the investment in single asset continuation vehicles have either performed in-line or above their expectations.

00:00:51 – 00:01:00

For multi-asset continuation vehicles, that figure is 36%. This positive trend is not surprising to us.

00:01:01 – 00:01:13

Assets typically enter continuation vehicles at a point of strong operational performance and often with clear visibility into the next phase of value creation.

00:01:13 – 00:01:27

Continuation vehicles have become the go to solution that allow both GPs and LPs to back their winners. While at the same time enhancing the alignment between stakeholders.

00:01:28 – 00:01:31

For more on these and other findings, please visit our website.

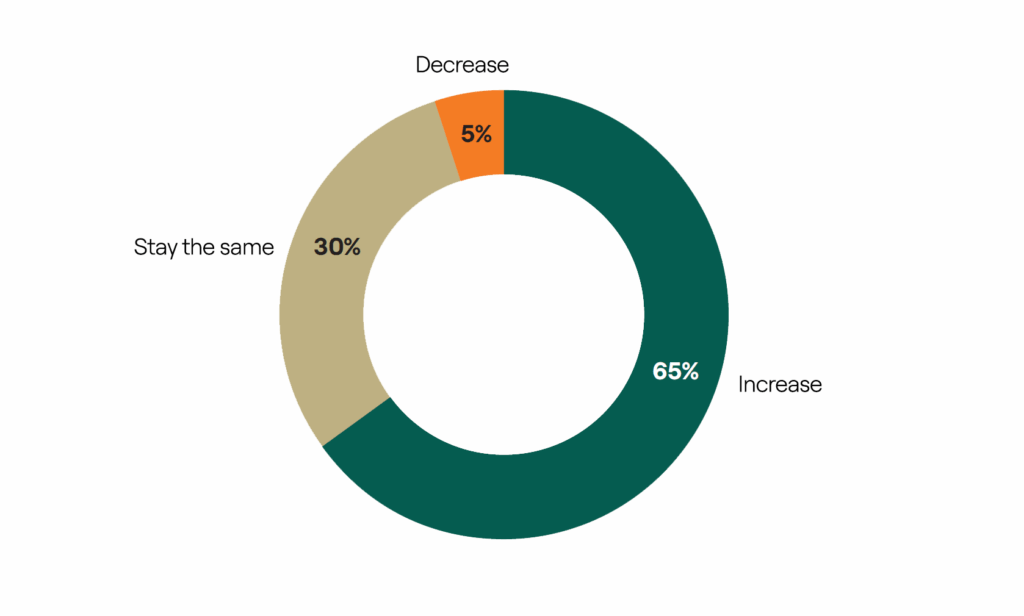

Keen to delve into investor sentiment across the broader GP-led spectrum we found that 65% of investors expect an increase in the volume of private credit GP-leds in the next two-to-three years. Testament to the fact that as private credit continues its robust growth trajectory, investor interest in secondaries within the asset class is also rising. As more private credit funds approach the mid-to-late stages of their lifecycle, sponsors can tap into CVs or other GP-led structures to retain assets while providing liquidity. Respondents from North American and Rest of World (RoW) incl. Middle East and North Africa (MENA) expressed the strongest expectation of such an increase, with three quarters anticipating this trend.

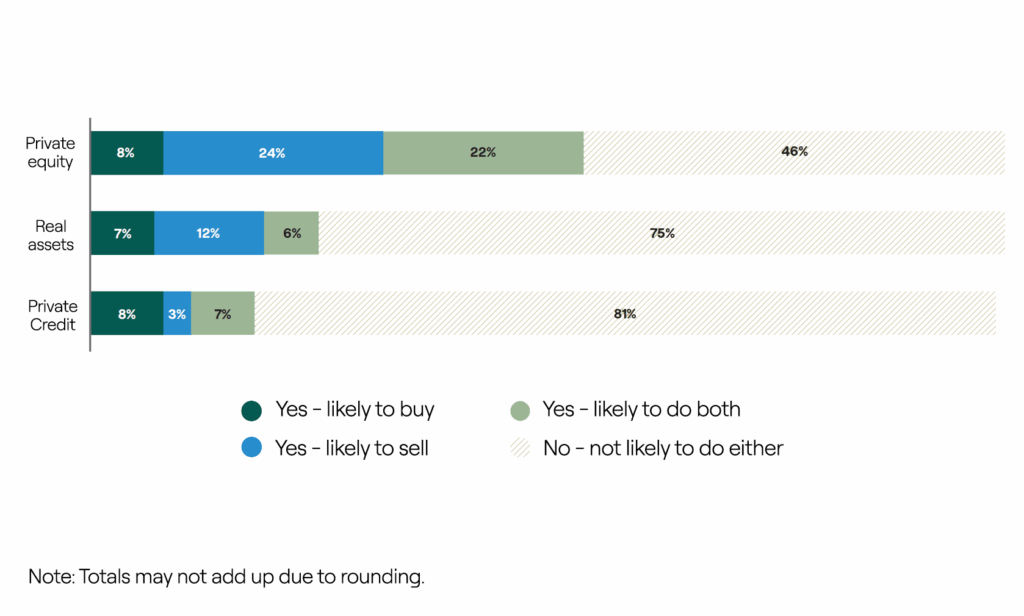

LP-led transactions remain an important part of the secondaries landscape. Over half (54%) of surveyed investors say they expect to buy and/or sell private equity assets in the secondary market in the next two years. This reflects private equity’s status as the most mature and established of the private asset classes. A quarter of respondents are planning real assets secondary transactions and 19% showed interest in private credit secondary processes.