Geopolitical risk – an increasing consideration in portfolio construction for many LPs

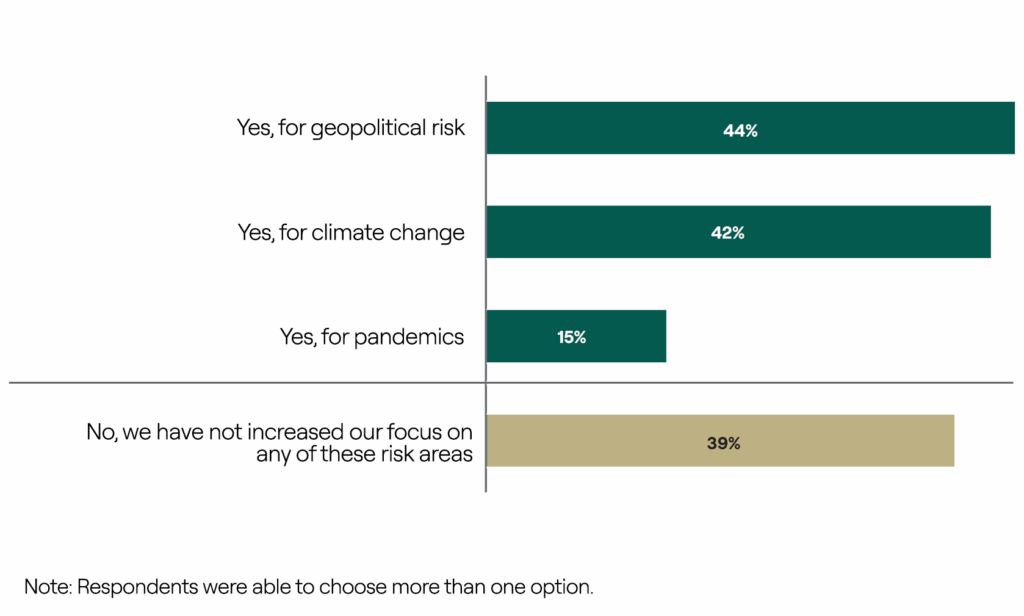

In an increasingly complex global landscape, 44% of LPs report that their institutions have increased their focus on geopolitical risk when constructing portfolios. This reflects growing concerns that political instability, regional conflicts and trade tensions could affect asset performance and capital allocation. Climate change emerged as the second biggest risk factor: it garnered 42% of votes, underscoring the expanding role of environmental risks in shaping investment decisions.

00:00:05 – 00:00:12

Geopolitical risk and portfolio construction are high on the priority list...

00:00:05 – 00:00:12

Geopolitical risk and portfolio construction are high on the priority list for LPs.

00:00:13 – 00:00:19

44% of LPs said that they have increased focus on geopolitical risk in the last five years.

00:00:20 – 00:00:27

Reflecting the recognition that political instability and regional conflicts can impact performances.

00:00:28 – 00:00:46

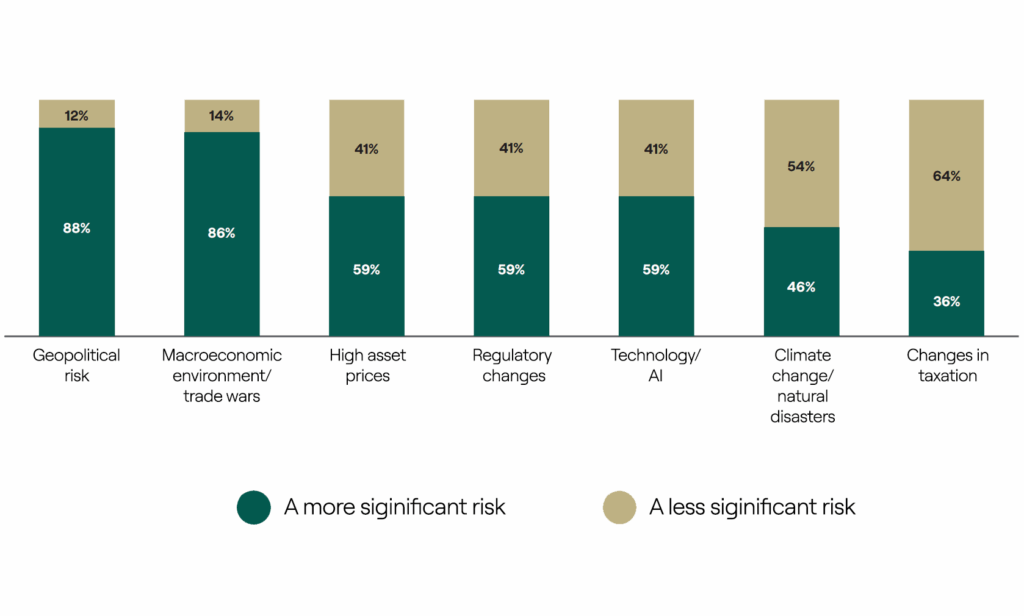

Looking at future risk to private equity return over the next 2 to 3 years. Perhaps unsurprisingly, geopolitical risk and market volatility were seen by investors as the key risk facing private equity returns.

00:00:47 – 00:00:50

To find out more, see the full report on collercapital.com

In a separate finding, investors identified geopolitical risk alongside the broader macroeconomic environment as significant threats to overall private equity returns. As inflationary pressures, macroeconomic instability and shifting trade policies create uncertainty, we believe investors will emphasise resilience and diversification in their portfolios to mitigate increasingly intertwined systemic and idiosyncratic risks.