Private credit and secondaries are top strategies for LP allocation increase plans in the next 12 months

Of all alternative assets, private credit remains the most popular among the LPs who responded, with nearly half (45%) of respondents planning to increase allocations to the strategy, up from 37% who said this in our previous Barometer just six months earlier. Secondaries came in second, with 37% planning to allocate more here, also up from last time.

00:00:04 – 00:00:09

Private credit remains top of investors’ minds and for good reason.

00:00:04 – 00:00:09

Private credit remains top of investors’ minds and for good reason.

00:00:10 – 00:00:18

As we look ahead to the next 12 months, nearly 45% of LPs responding to our survey expect to increase the allocation to this strategy.

00:00:19 – 00:00:24

This is up from 37% reported in our last Barometer from six months ago.

00:00:25 – 00:00:42

In a world marked by volatility and uncertainty, private credit has emerged as a resilient and attractive asset class. If you look at the subsegments within private credit, investors expect corporate and commercial credit to be the most compelling opportunity of those represented.

00:00:43 – 00:00:50

Nearly 60% of LPs identified this segment as the most attractive, over the next 3 to 5 years.

00:00:51 – 00:01:01

In an environment marked by uncertainty, investors are leaning into strategies that offer downside protection, combined with the potential for attractive returns.

00:01:01 – 00:01:05

View the full report on our website, for more details on these findings.

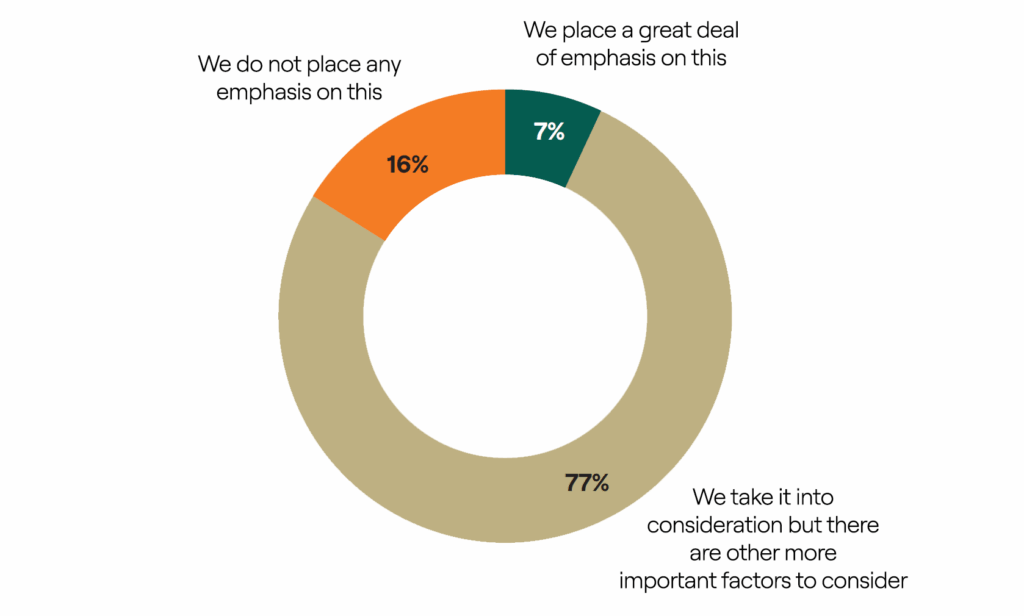

The recent fundraising environment has undoubtedly been challenging, with activity levels significantly down from the peak recorded in prior years. Unsurprisingly over four-fifths of LPs take fundraising momentum into consideration when evaluating a particular GP, with 7% placing a great deal of emphasis on this.

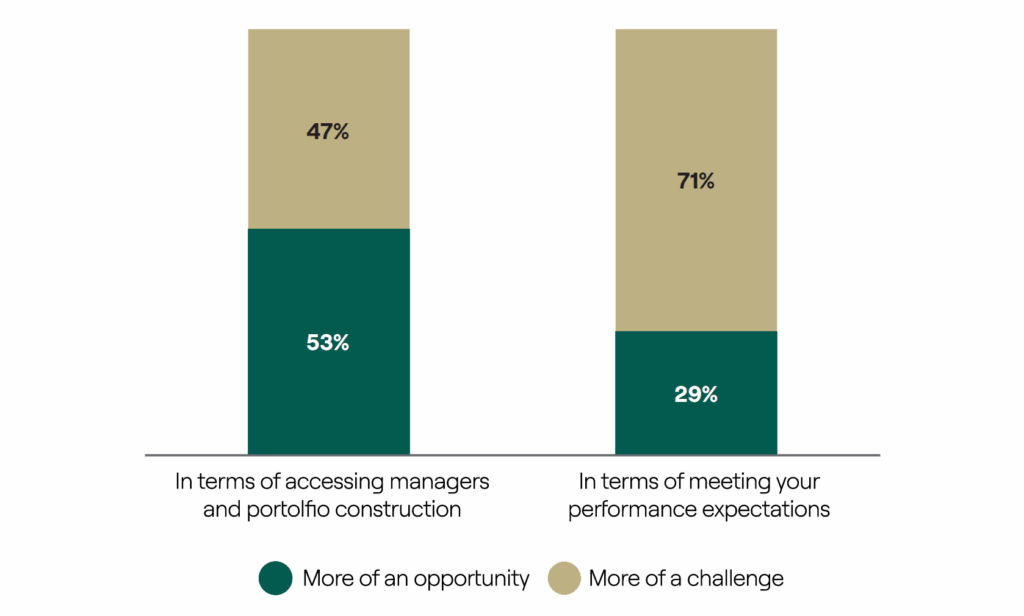

Against this backdrop, mega-funds (funds with size in excess of $20bn) have become a frequent feature of today’s market with a number of managers launching such funds in recent years. More than half of LPs believe that they represent more of an opportunity from an access to managers and portfolio construction perspective. However, with regards to performance LPs are sceptical about this trend: over 70% see this as a challenge for them in meeting their performance expectations. This suggests LPs believe returns will be affected as mega-fund managers may struggle to source investments and/or actively manage them.

New challenges call for new strategies, so as the world continues to confront increased geopolitical and economic uncertainty, it’s no surprise that investors are exploring alternative options to deliver returns. As our 42nd Global Private Capital Barometer shows, LPs are continuing to increase their interest in private credit and secondaries and making new forays into evergreens.

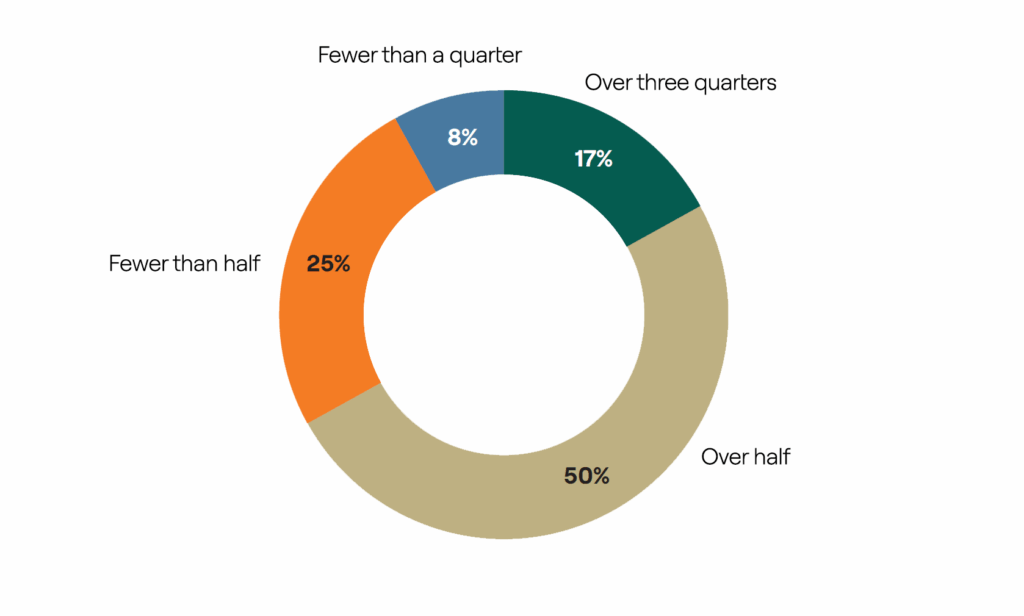

A third of LPs expect that fewer than half of their current top 10 GPs (by total commitments) will remain in that group a decade from now. This suggests that LP loyalty, even in large, long-standing relationships, should not be taken for granted.

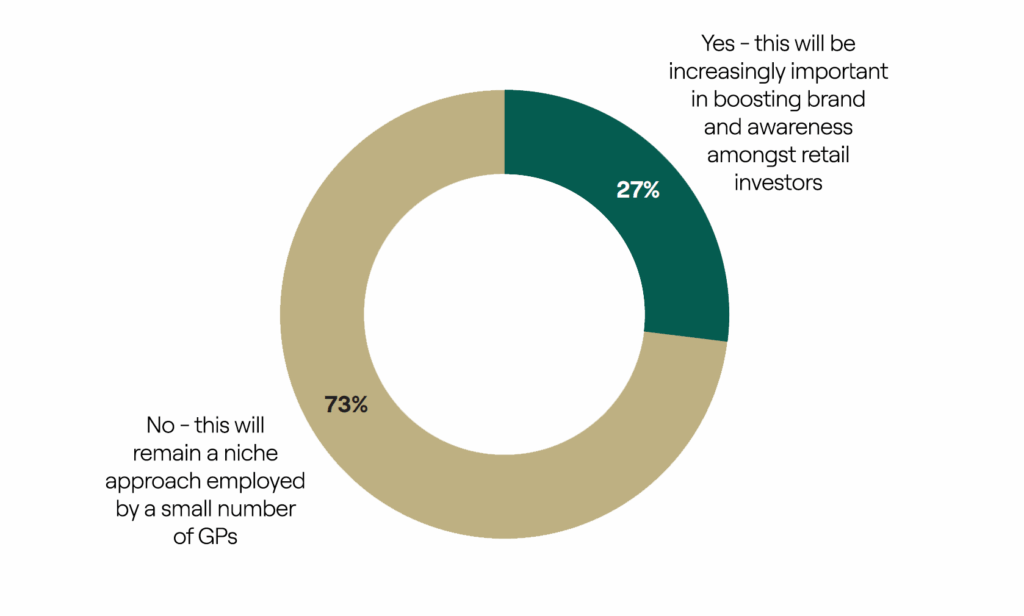

With the rise of influencers across a range of industries we were eager to find out investor views towards celebrity collaboration with PE firms. Over a quarter (27%) say this will be more important in the next two-to-three years for boosting brand recognition and awareness especially among retail investors. North American and APAC investors were more inclined to agree than European LPs, who feel this will remain a niche approach. Further variances emerged by institution: 51% of banks believe celebrity collaboration will become more important vs. the overall average of 27%.