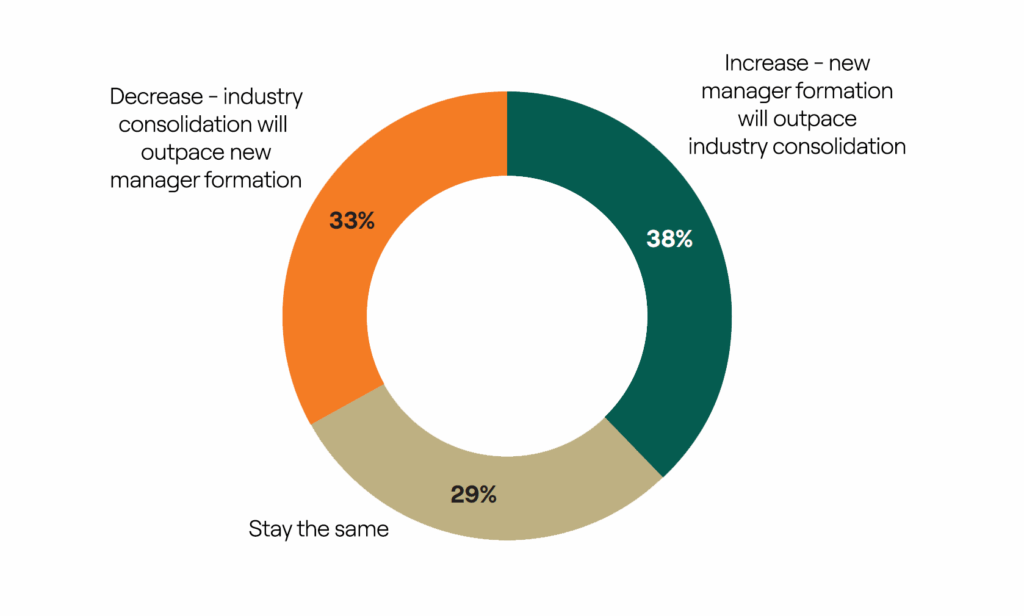

Over a third of LPs expect new manager formation to outpace industry consolidation

Mergers & Acquisitions (M&A) among private markets firms may have hit the headlines recently, but well over a third (38%) of Limited Partners expect new manager formation to outpace industry consolidation over the next three-to-five years. Asia Pacific (APAC) LPs are the most likely to believe this, with 64% expecting more emerging managers than mergers.

This reflects private markets’ increasing maturity: emerging managers tend to launch with specialist strategies in underserved segments, offering LPs the potential for differentiated alpha in niche strategies.

00:00:05 – 00:00:15

In this edition of the Barometer, we asked investors about the...

00:00:05 – 00:00:15

In this edition of the Barometer, we asked investors about the rise of mega funds. That is to say, funds of at least $20 billion in size.

00:00:15 – 00:00:22

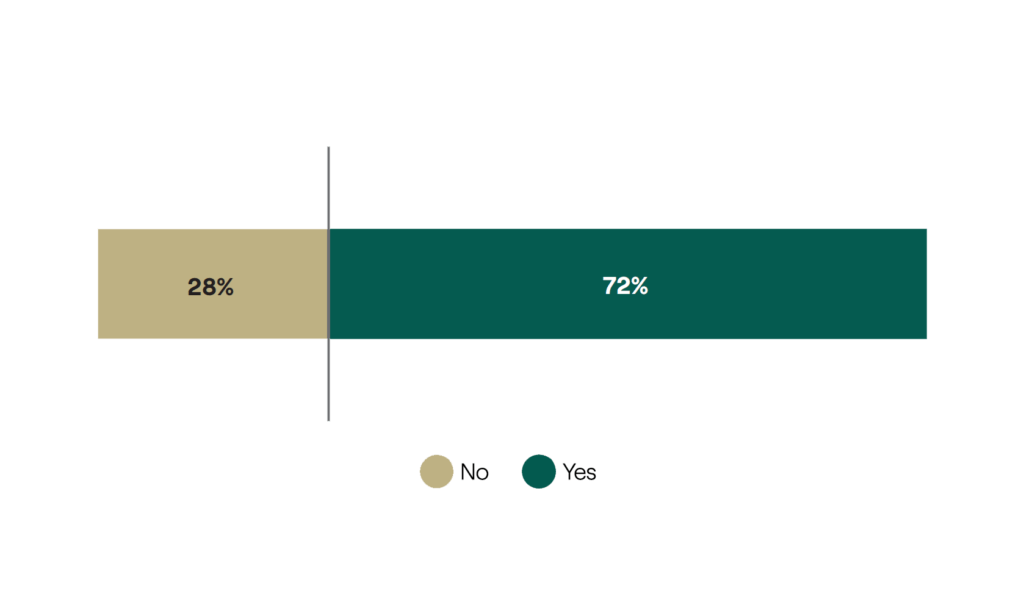

Nearly three quarters of investors believe that mega funds pose a potential threat to performance expectations.

00:00:23 – 00:00:27

We believe it’s driven by two factors.

00:00:27 – 00:00:39

Firstly, the ability for managers to source sufficient investments of scale. And secondly, the ability to manage investments in a fund of that size.

00:00:39 – 00:00:54

Either way, investors believe that the rise of mega funds is a potential threat to performance. Elsewhere in the Barometer, we asked investors about industry consolidation.

00:00:55 – 00:01:05

Now, despite the pace of consolidation within the industry, almost 40% of investors believe that new manager formation will outpace GP consolidation.

00:01:06 – 00:01:10

And we believe that’s a very healthy sign of a private capital market.

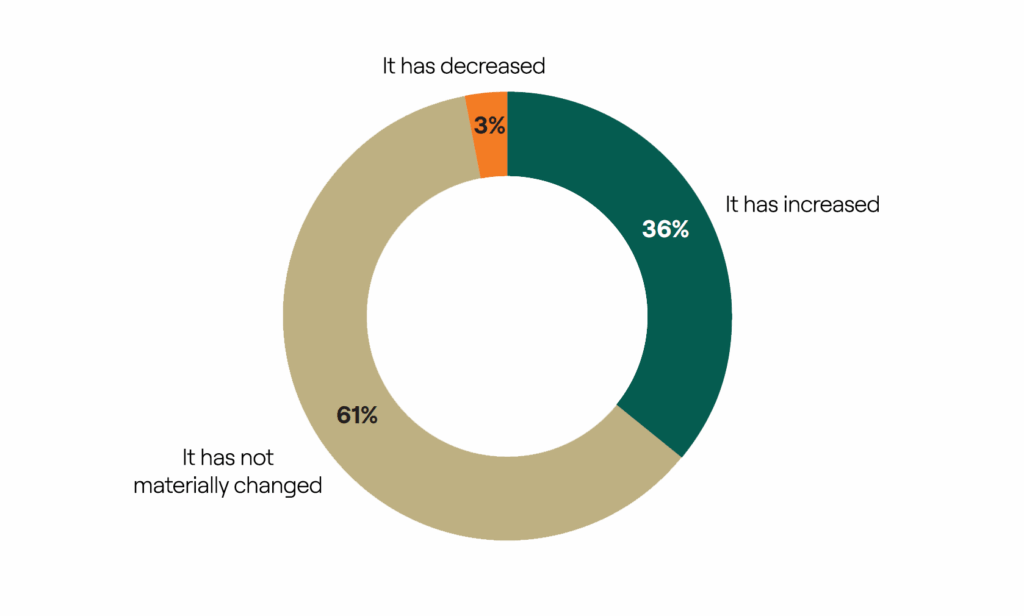

The past few years have seen a wave of GP spin-outs as professionals from established firms launch their own investment firms: 36% of respondents have seen an increased number of spin-outs in their own portfolios in the past two-to-three years.

Motivations for spin-outs differ and can include factors such a generational transition in firms and LP demand for differentiated strategies. However, some of the observed rise in spin-outs could be down to poor talent retention practices among some GPs.

Nearly a third of LPs believe that GPs are not doing enough to nurture home grown talent and retain the next generation of dealmakers. Again, APAC LPs were most likely to say this.