Most private equity investors think they’re diversified if they own enough funds. They’re measuring the wrong thing. Diversification can lower risk without giving up return, a rare “free lunch” in investing. But in secondaries, where we’re buying into existing portfolios of companies, the real question isn’t “how many funds?” but “how many companies are we actually exposed to, and how diverse are those exposures?”

Fund count can mislead

Two secondary portfolios with the same number of funds can look nothing alike once you look through to the companies underneath. One might give exposure to two companies, another to 50, because fund concentration varies widely, especially in tail-end funds, where most assets have been sold, leaving only a handful of concentrated positions.

What our analysis shows

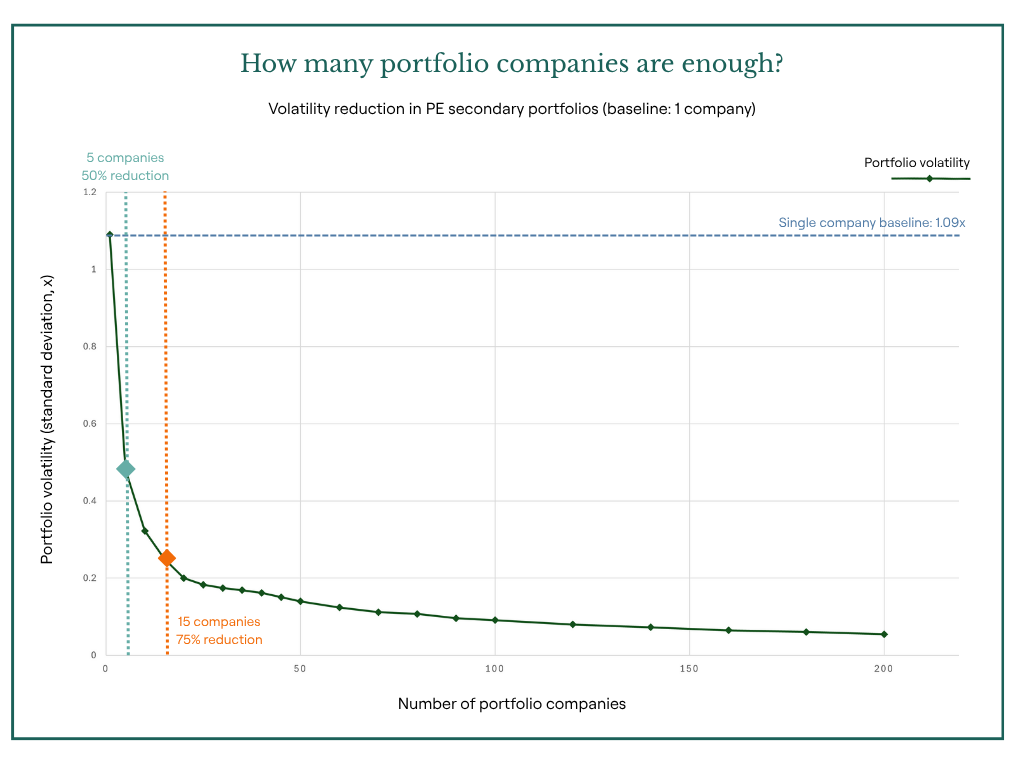

Looking at realised buyout outcomes and simulating company-level exposures, we see that adding companies keeps returns broadly steady while sharply reducing volatility by 70-90%. Think of it as smoothing the ride without slowing the car. Portfolios are rarely perfectly equal-weighted, so focus on “effective company count“, how diversified the portfolio really is after position sizing.

Three simple waypoints for company count

| . | ||

5 companies: |

Diversify away roughly 50% of portfolio volatility – a good start but still leaves meaningful concentration risk. | . |

|

|

||

15 companies (equal-weighted): |

Capture about 75% of the diversification benefit. | . |

|

|

||

100 companies: |

Diversify away approximately 92% of volatility, this level provides strong downside resilience and highly predictable outcomes. | . |

| . | ||

The hidden benefit: predictability

As company count rises, the range of outcomes narrows. That tighter band helps with real-world needs: planning distributions, meeting pacing targets, managing liquidity, and explaining performance to investment committees with confidence.

How we build robust, resilient secondary portfolios

Counting companies is the rule of thumb, but resilience comes from diversifying across multiple dimensions:

Industry: Avoid one sector dictating outcomes.

Geography: Reduce exposure to single-country macro or policy shocks.

Fund vintage: Spread across cycles to avoid timing clusters.

Investment date: Stagger entry points to smooth exit profiles and cash flows.

This layered approach aims to deliver stronger risk-adjusted returns, stable compounding, fewer drawdowns, and higher confidence that outcomes land near target ranges.

Practical guardrails

Under-diversified: Fewer than 5 equally weighted companies often concentrate risk more than most LPs expect.

Good baseline: 40–50 companies typically balance risk reduction with efficiency in monitoring and reporting.

Extra cushion: 100 companies can materially shrink tail risk and improve predictability for program-level planning.

Always ask: What’s the effective company count after weighting? How are exposures distributed across sectors, regions, vintages, and investment dates?

Looking at realised buyout outcomes and simulating company-level exposures, we see that adding companies keeps returns broadly steady while sharply reducing volatility by 70-90%. Think of it as smoothing the ride without slowing the car.

How are we different?

We look through to the companies and their weights, not just the funds, and then intentionally spread exposures across industries, geographies, vintages, and time. The result: robust, resilient portfolios designed to deliver strong risk-adjusted returns through cycles.

The final word

In secondaries, the free lunch is company-level diversification. Start by counting companies, and then make sure those companies are thoughtfully diversified across sectors, regions, vintages, and entry dates. That’s how a portfolio that is both resilient and primed for strong risk-adjusted performance can be constructed.

Analysis based on Monte Carlo simulation of realised buyout exits across 68 reference dates (first reference date: 1997-06-30, last reference date: 2024-09-30). Simulations assume equal weighting and hold transaction mechanics (discount, economics) constant. Results averaged across multiple market environments to ensure robustness.