We look at the basics of the private capital secondaries market, and decipher the everyday jargon associated to it. We hope to help you understand the fundamentals to help navigate the secondaries market.

What are secondaries?

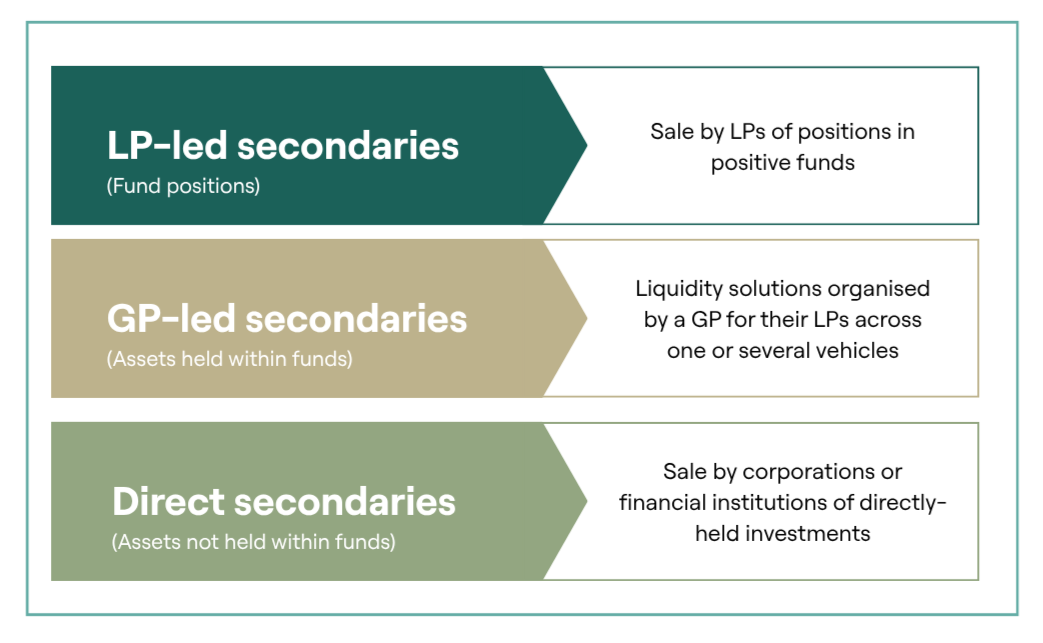

Secondaries, or ‘secondary transactions,’ refer to investments in existing private market funds or assets, allowing investors to buy or sell positions before those funds fully mature. Unlike public markets, where stocks and shares are traded openly, these transactions are negotiated directly between investors and businesses, often facilitated through private funds.

In essence, the private capital secondaries market is the re-sale market for investors’ interests in private market funds and direct investments – where one investor purchases an existing asset from another. This market provides the only mechanism for private market investors (LPs) to exit early from their commitments and enables fund managers (GPs) to offer additional liquidity options to their investors.

Why invest in private capital secondaries?

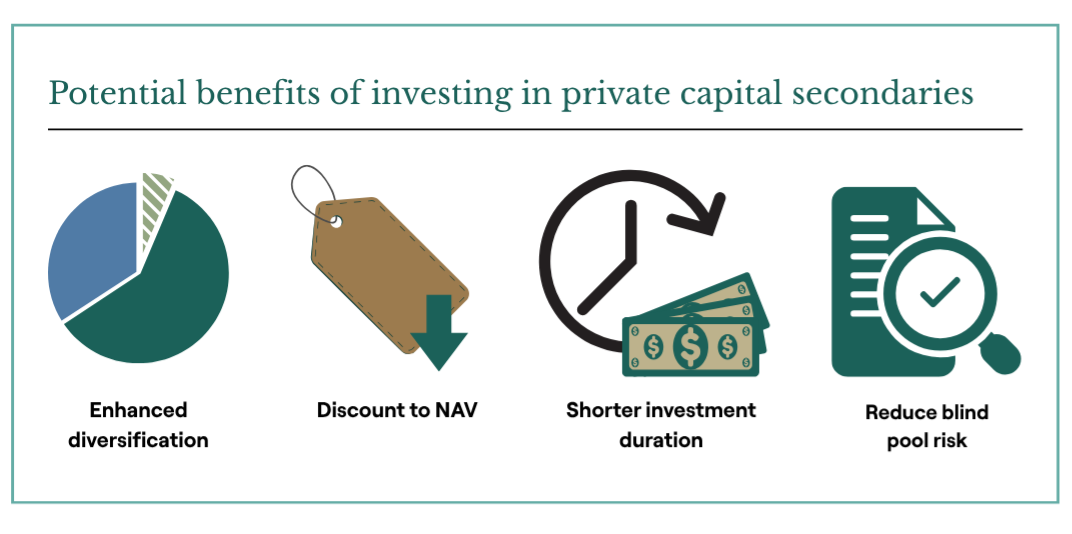

Secondaries funds can offer investors returns that are differentiated to other private market strategies. On a risk adjusted basis these returns are particularly attractive, as a consequence of certain typical secondary investment characteristics, including:

- Enhanced diversification

- Acquisition of underlying investment at a discount to NAV

- Shorter investment duration

- Reduction of blind pool risk

The growth of the private capital secondaries market has accelerated in recent years as a consequence of an expanding primary market, allowing LPs an opportunity:

- To achieve early liquidity from their private markets assets;

- To manage their portfolios more proactively;

- To modify their business models in response to regulatory or strategic change;

- To lock-in returns from their private markets investments.

What is primary investing?

Primary investing allows investors to participate in a GP’s fund from the outset, providing access to a diversified portfolio of assets managed by experienced professionals. While the specific investments are not known at the time of commitment – introducing what’s called ‘blind pool’ risk – this approach offers the potential for strong returns through early engagement in the fund’s lifecycle.

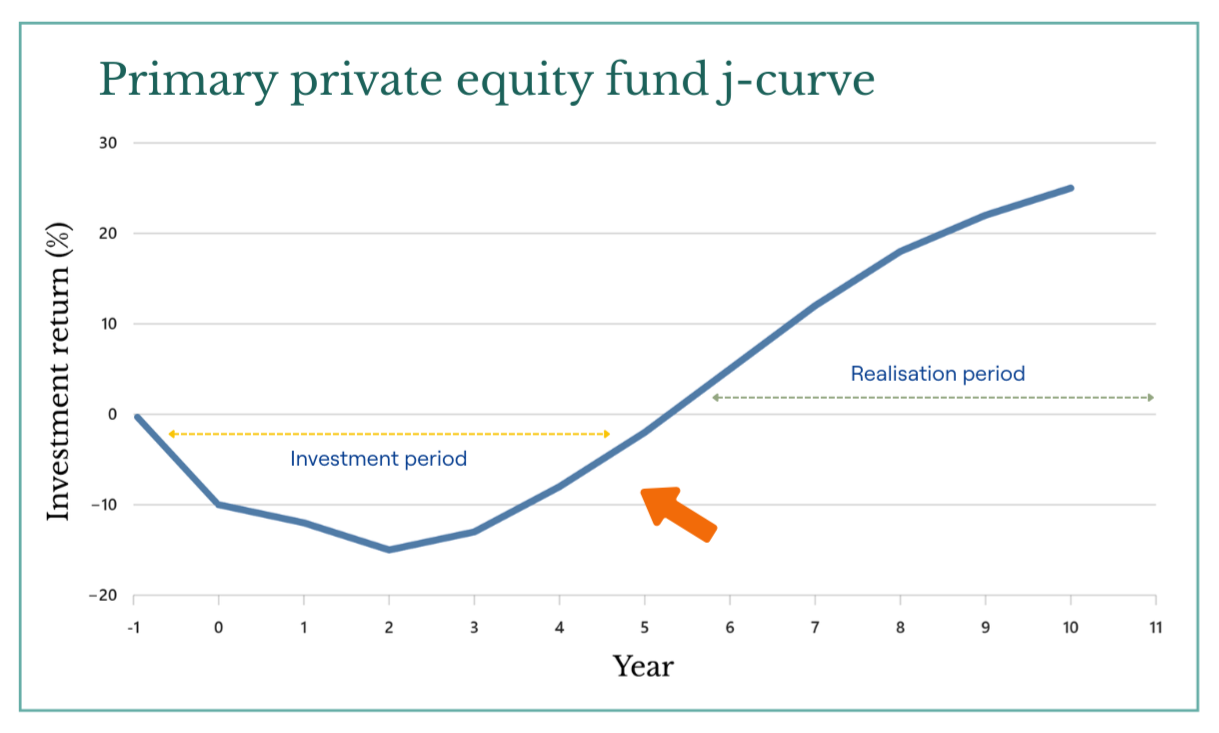

During the investment period, capital is gradually drawn and deployed into a range of opportunities, positioning the portfolio for growth. Although there is typically a phase where capital is invested before distributions begin, this is a natural part of building value. As assets mature and are realised, capital flows back to investors, creating the well-known ‘J-Curve’ return profile, which reflects the transition from initial investment to long-term gains.

What is secondary investing?

Secondary investing typically involves the acquisition of mature, substantially invested portfolios, often acquired at a discount to NAV, thus avoiding the ‘blind pool’ risk of the primary investment. Given the investments are more mature than those made by primary funds, distributions can be passed back to secondary fund investors faster. Also, secondary funds are typically much more diversified than primary funds given the multitude of underlying GPs, funds and exposure to portfolio companies.

What is an LP?

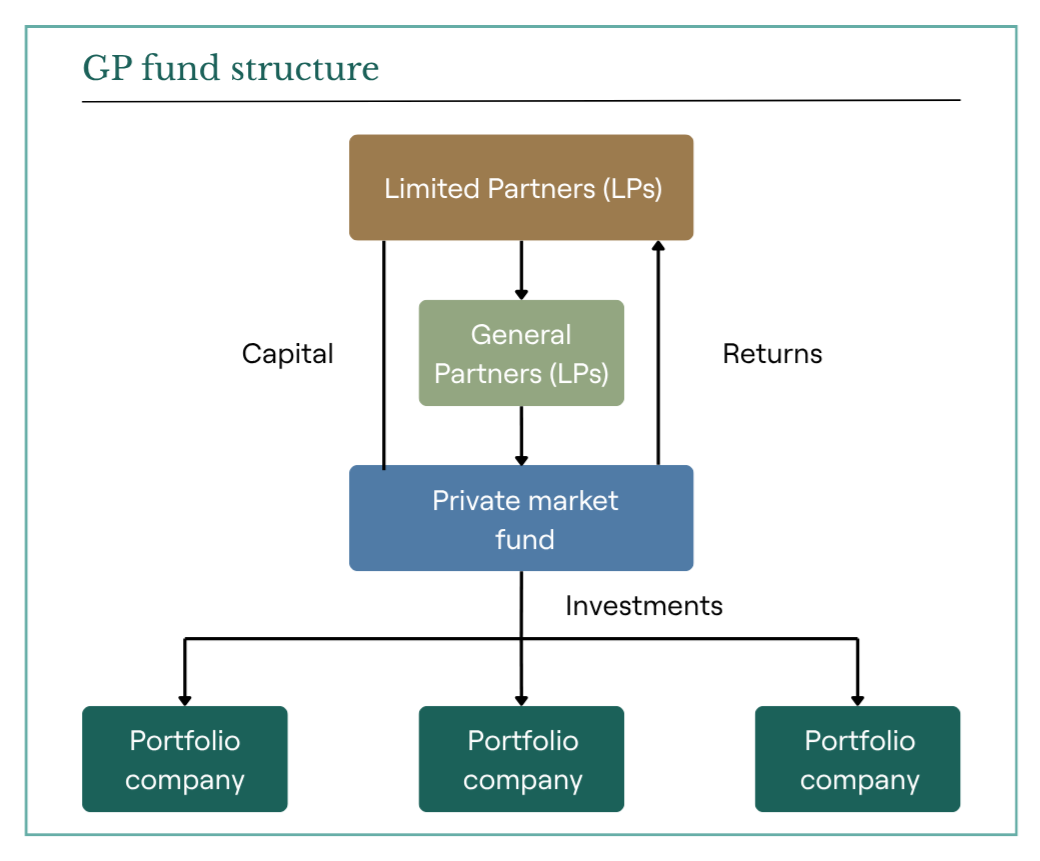

A Limited Partner (LP) is an investor contributing into private market funds that are managed by GPs. LPs have a limited liability with their investments and have no management authority; this lies with the GP.

What is a GP?

A General Partner (GP) is the private market fund’s partner that has the legal authority to make decisions for the fund. Under each fund structure, GPs are permitted to manage the private market fund and choose the investments to include in their portfolios.

What is the difference between a GP and LP?

LPs are inactive investors into the fund, they provide capital but as their name suggests, they have limited control over day-to-day involvement of its activities. GPs, on the other hand, are active investors; they are the strategic decision makers for the running of the fund.

What are GP-led secondaries?

GP-led secondaries are transactions initiated by a GP and are today an important segment of the private capital secondaries market. The most common form of a GP-led secondary is a continuation fund, which involves the sale of some or all of a fund’s existing assets to a new vehicle, which continues to be managed by the fund’s GP. The continuation fund is capitalised by the secondary buyer(s); usually, existing LPs can exit their position and take liquidity or ‘roll’ their existing interest into the new continuation fund. The secondary buyer will normally negotiate a new economic and governance agreement to ensure oversight of, and alignment with, the GP.

What are LP-led secondaries?

LP-led secondary transactions occur when LPs sell interests in funds to other investors, typically secondaries funds. The purchasing investors become replacement LPs in the funds in question and assume the original investors’ obligations.

What is NAV?

Net Asset Value is the total value of a fund’s assets minus its liabilities, often expressed per share . It reflects the estimated value of the fund and plays a key role in tracking performance, keeping investors informed, and guiding important decisions – like capital calls or distributions.

What is blind pool risk?

Blind pool risk occurs when investors commit to a primary private market fund before it’s made any investments. In other words, it’s like trying to pick the winner of a race before it’s started . For example, when GP starts a fund with no specific investments in place, it is unknown if they will invest wisely and manage risks effectively.

What is dry powder?

Dry powder is the cash reserve that is waiting for be spent. It refers to the amount of capital that has been committed but unallocated into an active investment. Having funds held in dry powder allows quick investment opportunities as they arise.

Understanding the J-curve

The ‘J-curve’ is a concept used to describe the typical cash flow pattern in private market funds, where the capital drawdowns and distributions follow the shape of the letter ‘J’. In the early years of a fund, you’ll often see negative performance, represented by the curved part of the J. This occurs because capital is being deployed to cover fees, operational expenses, and to make new investments. As the fund progresses and investments grow, returns often rise above the initial costs and the fund starts generating positive gains. This turning point is shown by the upward curve of the J.