GPs are gearing up for 2026 portfolio company IPOs, while DPI (Distributions to Paid-in Capital) was the private markets buzzword

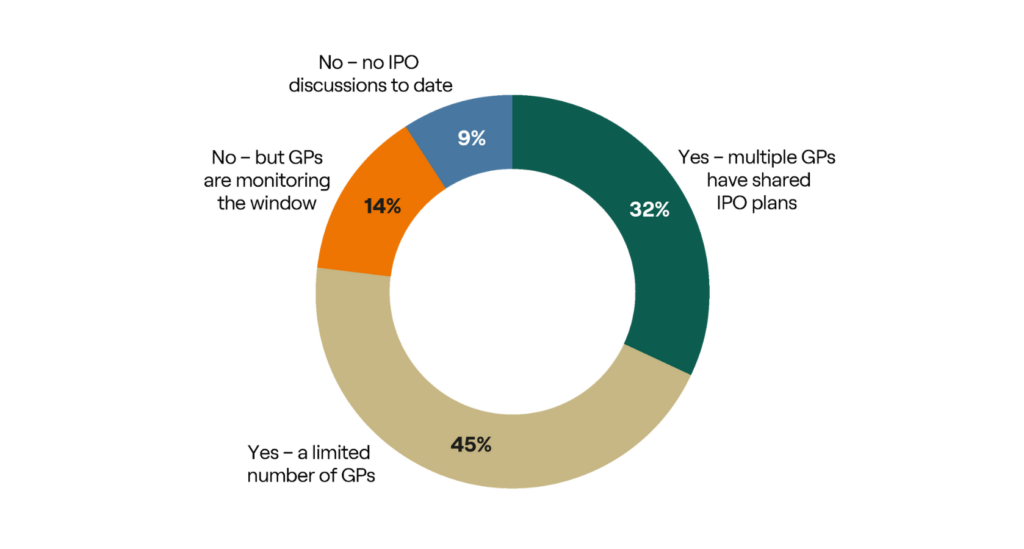

Our findings also paint an encouraging outlook for GP positioning in 2026. Notably, 77% of LPs report that their GPs have indicated IPO plans for their portfolio companies in 2026, including 32% who report that several managers have shared IPO plans. There is particularly strong IPO exit momentum in APAC, with 87% of LPs reporting IPO discussions, followed by Europe and North America.

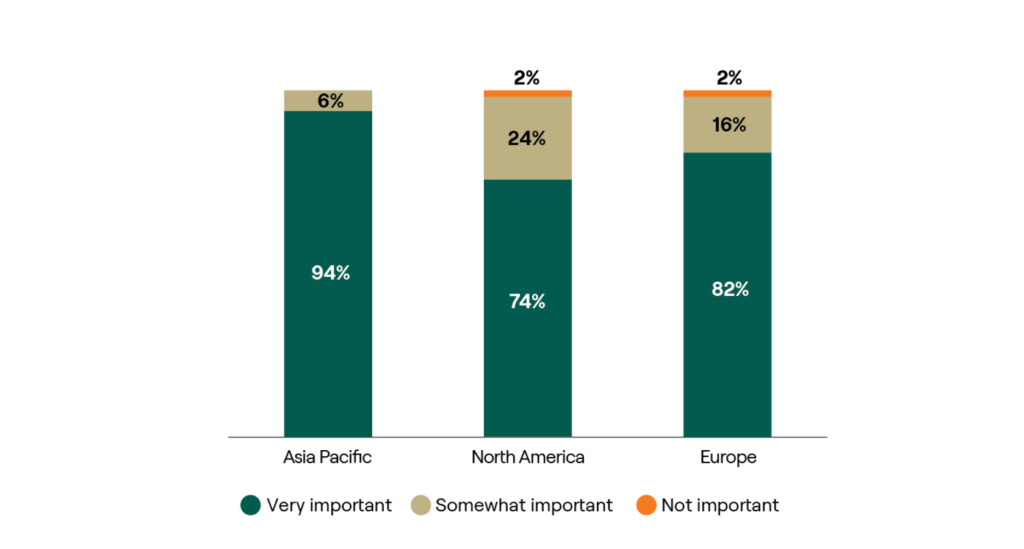

LPs also place significant value on the importance of managers having a local presence in the markets in which they operate, with 94% viewing it as very important in APAC, 82% in Europe and 74% in North America.

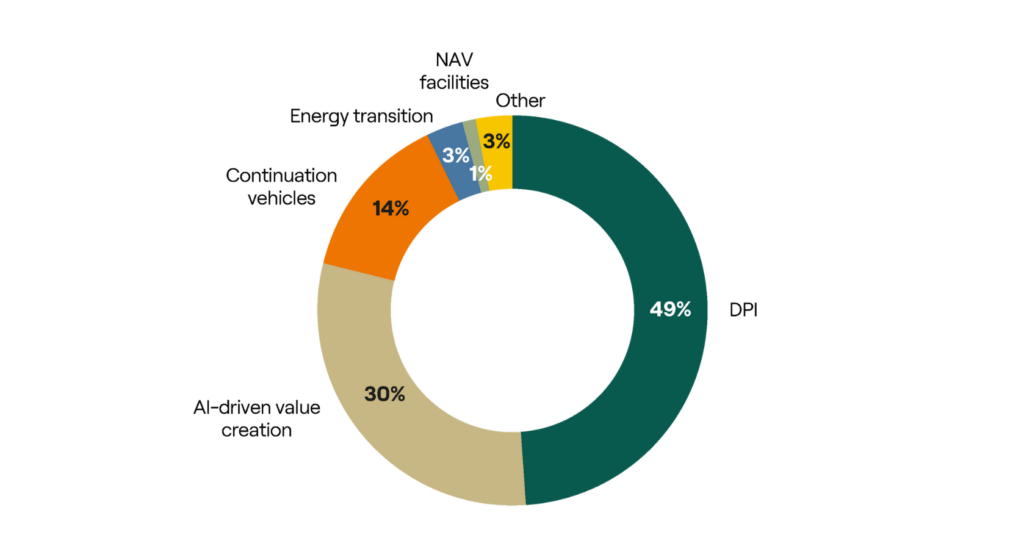

Meanwhile, DPI was the buzzword of 2025 in GP pitches, according to LPs. This garnered nearly half the votes, perhaps unsurprisingly in the current liquidity constrained environment.