LPs are planning increased exposures to India and Japan

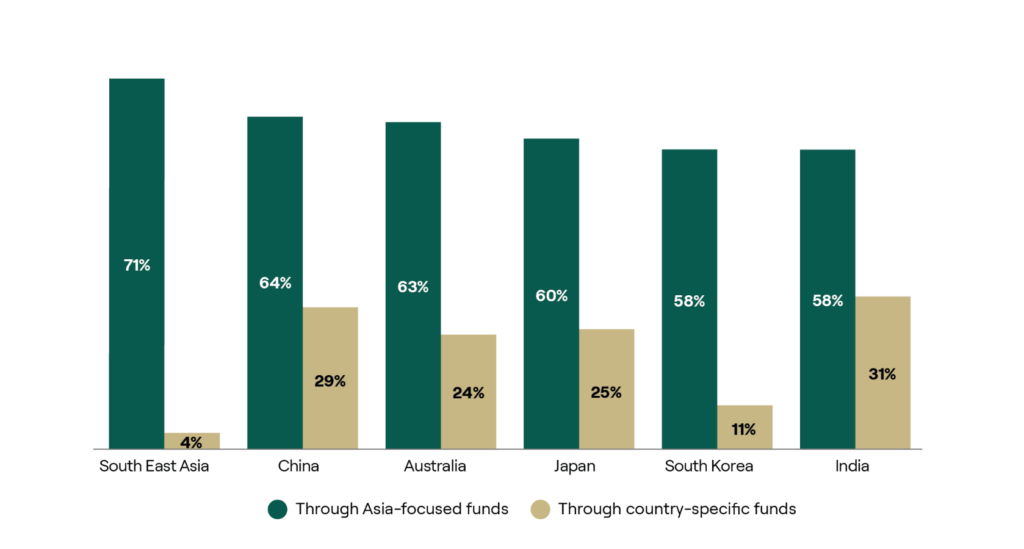

The APAC private capital market findings reveal a twin-track investment approach among institutional investors when accessing opportunities across the region. Asia-focused funds dominate as the preferred vehicle, with 71% of LPs using them to access South East Asia (SEA), 64% for China and 63% for Australia. Meanwhile, LP deployment in country-specific funds is more selective, led by India with 31%, China with 29%, and Japan with 25%.

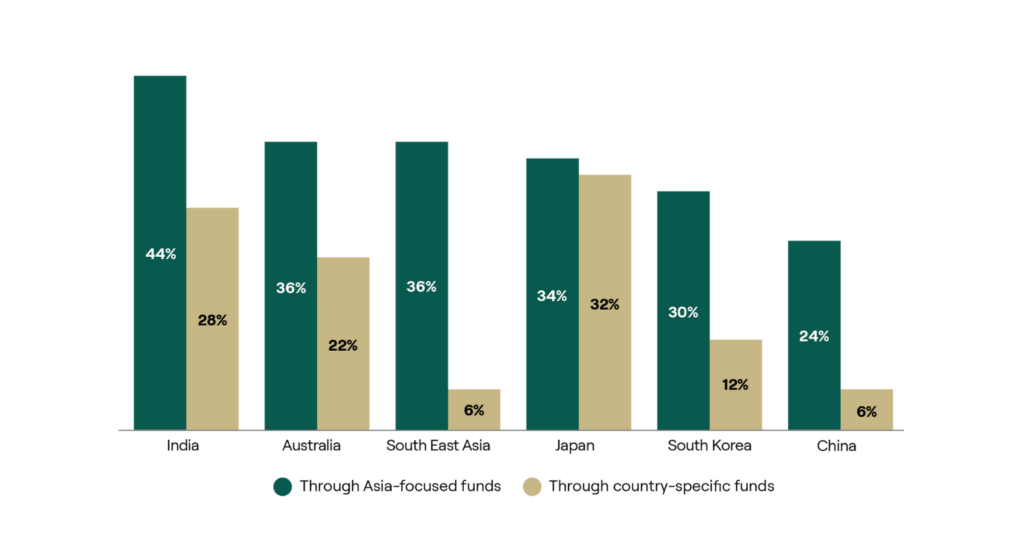

Looking ahead, India is emerging as a frontrunner for attracting investor capital over the next three years, with 44% of LPs planning to increase exposure to the market via Asia-focused funds and 28% using country-specific vehicles. There is also strong appetite for Japan, with 34% planning to increase exposure via Asia-focused funds and an 32% using country-specific funds. This suggests a renewed confidence among LPs in the maturity and accessibility of the Japanese market.