LPs believe the rise of private wealth channels will enhance investor protection and reporting

Private markets are undergoing a structural evolution as GPs increasingly tap alternative sources of capital, including retail investors and insurers.

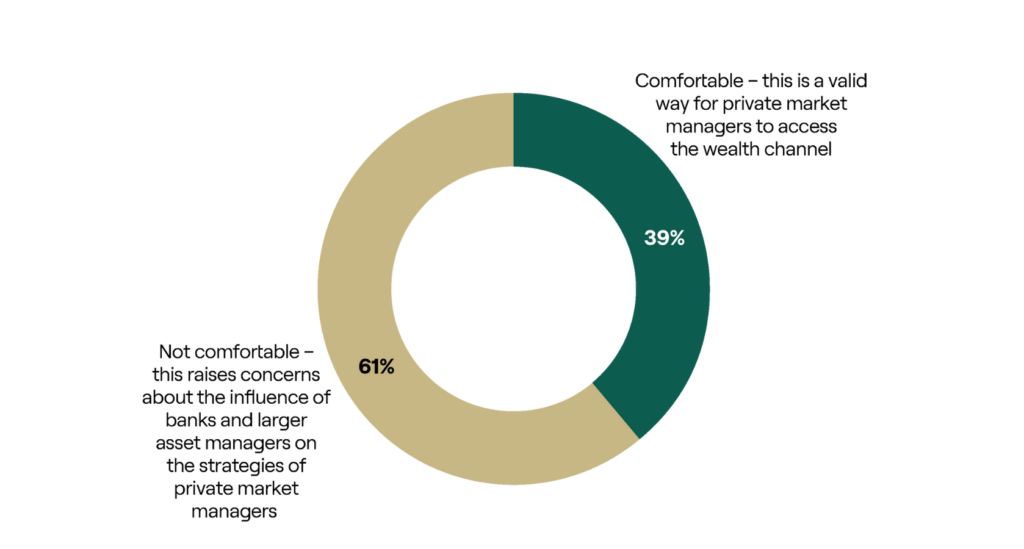

Navigating manager partnerships to access the wealth channel may require thoughtful consideration, but a significant minority (39%) of LPs are already comfortable with private market managers forming strategic partnerships with banks and larger asset managers as a valid route to access private wealth clients.

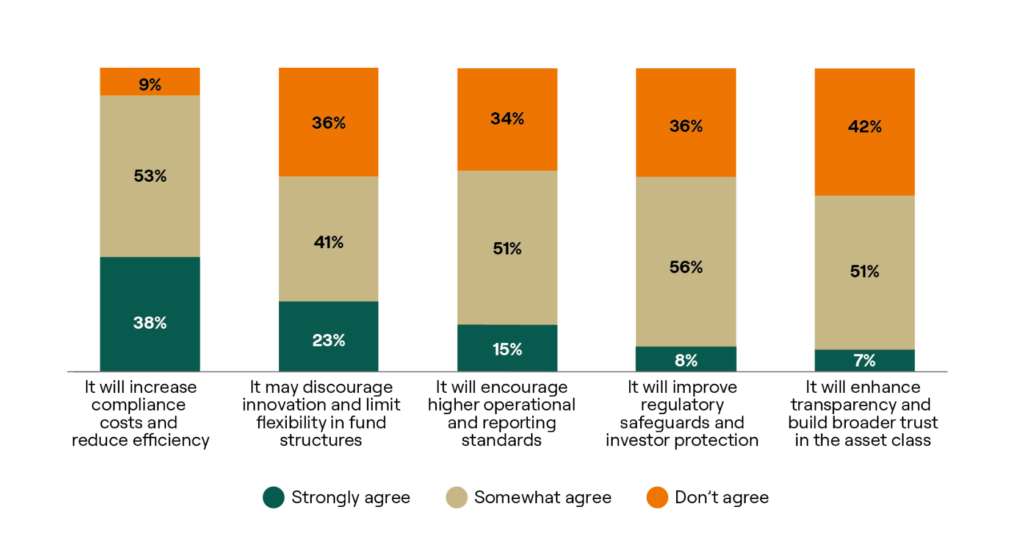

Investors also believe that increased scrutiny will lead to improved regulatory safeguards and investor protection, with 64% holding this view. Two-thirds (66%) also expect this to encourage higher operational and reporting standards, which in effect, should drive best practice adoption that benefits all investor classes.

While nine in 10 respondents believe that increased scrutiny could increase compliance costs and reduce efficiency, this is perhaps best viewed as an investment in market credibility and long-term sustainability, rather than an obstacle.