Private credit set for higher allocations, with GP-led secondaries expected to grow

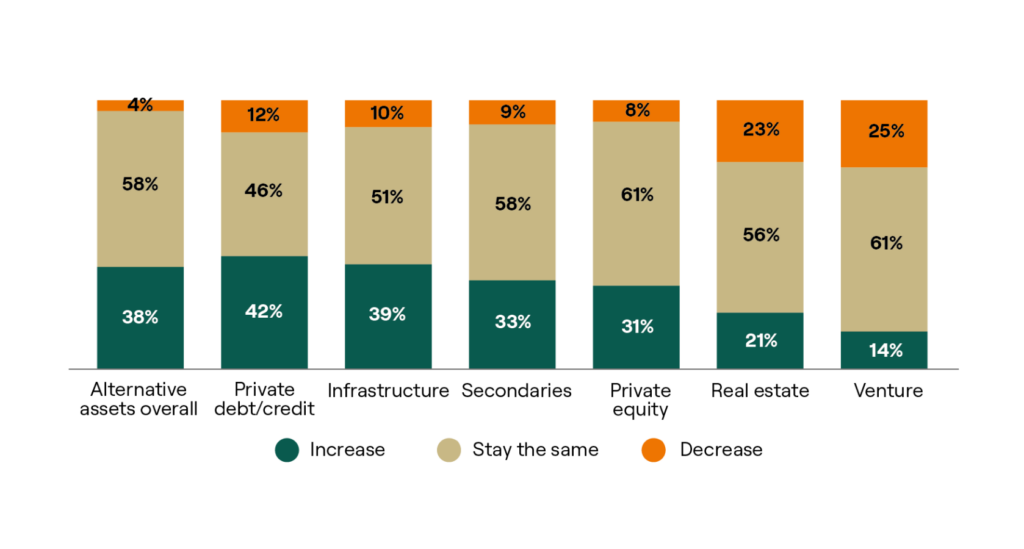

Private credit continues to attract investor capital and, consistent with previous Barometer findings, looking across all areas of private markets, it is the segment where most LPs are planning to increase allocations in the next 12 months: 42% say this.

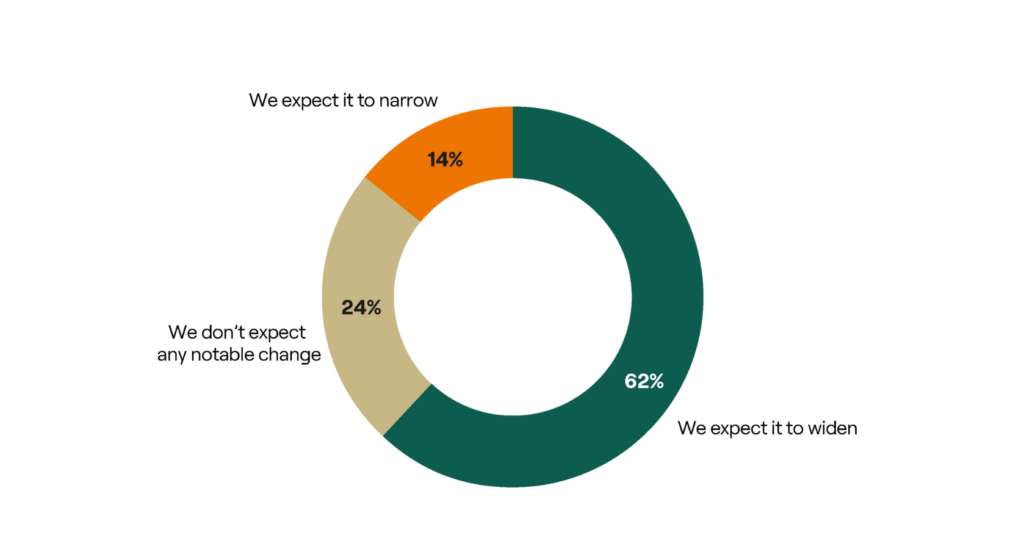

However, they are approaching the market with caution. Nearly two-thirds (62%) of institutional investors expect the dispersion of returns among private credit managers to widen over the next one to two years, underscoring the importance of manager selection. At 73%, APAC LPs are the most likely to expect a wider return distribution in the period ahead.

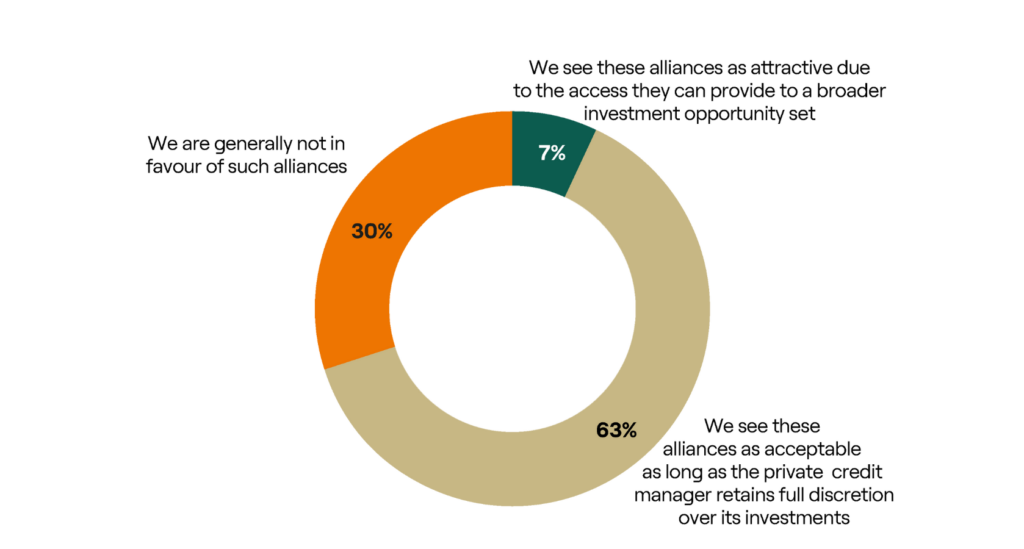

Our respondents appear open-minded about private credit managers forming strategic alliances with banks, insurers and other credit‑focused institutions to access deal flow. These alliances are rated by 63% of LPs as acceptable, provided that the private credit manager retains full discretion over investment decisions, while 7% view them as attractive.

00:00:07 – 00:00:16

Private credit continues to see strong investor interest and for the...

00:00:07 – 00:00:16

Private credit continues to see strong investor interest and for the third consecutive year, it’s the strategy where most surveyed LPs plan to increase allocations.

00:00:16 – 00:00:24

In our latest Barometer, 42% of LPs say they plan to commit more to private credit over the next 12 months.

00:00:25 – 00:00:28

But while interest is strong, LPs are approaching the market with caution.

00:00:31 – 00:00:40

Nearly two-thirds expect the dispersion in returns among private credit managers to widen over the next one to two years, which means manager selection will be critical.

00:00:40 – 00:00:46

APAC LPs are the most cautious, with 73% expecting wider return dispersion ahead.

00:00:46 – 00:00:56

With LPs positioned to become more discerning about manager selection, credit managers themselves are looking to find ways to differentiate their strategies and performance.

00:00:57 – 00:01:00

For more private credit trends, you can explore the full Barometer report.

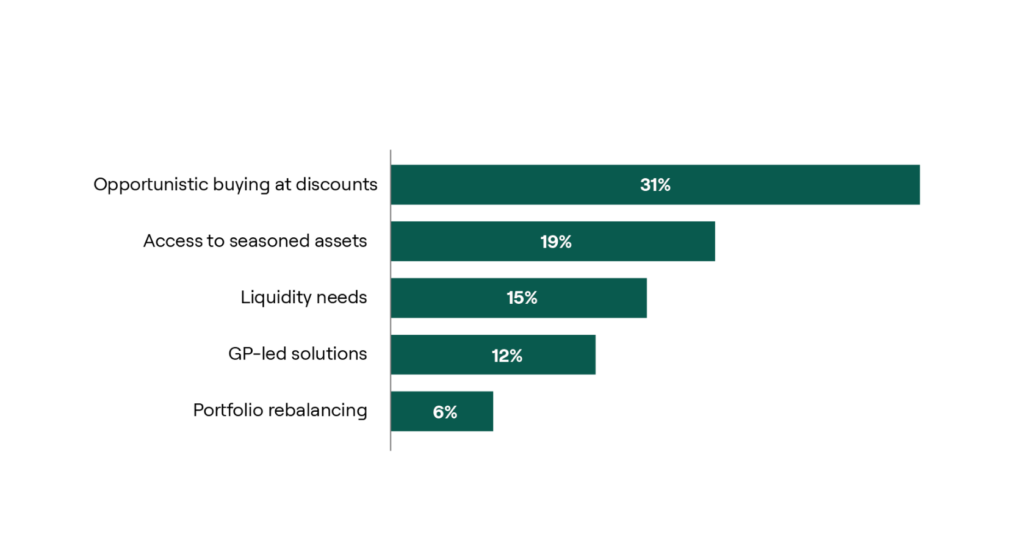

We also asked LPs about their motivations for being active in private credit secondaries over the next two to three years. For nearly a third of respondents (31%), opportunistic buying at discounts is the main reason, while for nearly a fifth (19%), access to seasoned assets is the main focus. This opportunistic orientation signals that early movers are keen to capitalise on a relatively nascent market.

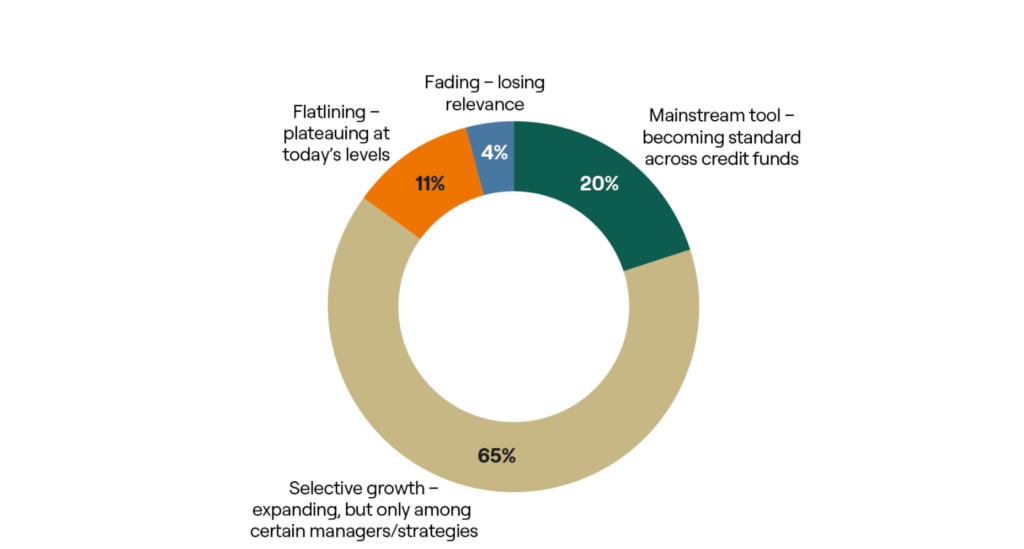

Looking ahead, 85% of LPs anticipate further growth of GP-led secondaries in private credit, 20% predicted they will become a mainstream tool across credit funds.

00:00:07 – 00:00:16

In our latest Barometer report, we explored surveyed LPs views on...

00:00:07 – 00:00:16

In our latest Barometer report, we explored surveyed LPs views on private credit secondaries and the findings show growing interest in this emerging market.

00:00:16 – 00:00:27

When asked about their motivations for being active in private credit secondaries over the next two to three years, nearly a third of respondents said opportunistic buying at discounts is their main reason.

00:00:27 – 00:00:31

Looking ahead, expectations for growth are strong.

00:00:31 – 00:00:37

85% of LPs expect further expansion of GP-led secondaries in private credit.

00:00:37 – 00:00:48

65% expect selective growth among certain managers and strategies, and 20% predict GP-led secondaries will become a mainstream tool across credit funds.

00:00:49 – 00:00:52

In short, private credit secondaries are shifting from what was considered a niche market a few years ago to a strategic priority for many LPs.

00:00:59 – 00:01:04

Our view is that this market is evolving fast and poised for significant continued growth.

00:01:05 – 00:01:08

For more trends, you can read the full Barometer report.