Late primaries are gaining traction among LPs as a way of evaluating a fund’s prospects before committing

Late primary investments are commitments to private capital funds that are still fundraising but have already deployed significant capital into portfolio companies. Unlike traditional primary commitments made at a fund’s launch when investors commit to a blind pool, late primaries provide LPs with concrete evidence of how a GP is delivering on its investment strategy. This can be particularly valuable for LPs when evaluating emerging managers, new fund strategies, or GPs entering unfamiliar sectors or geographies. Late primaries also offer potential benefits for liquidity planning, as LPs use the fund’s existing deployment pace to forecast capital call timing and distribution patterns.

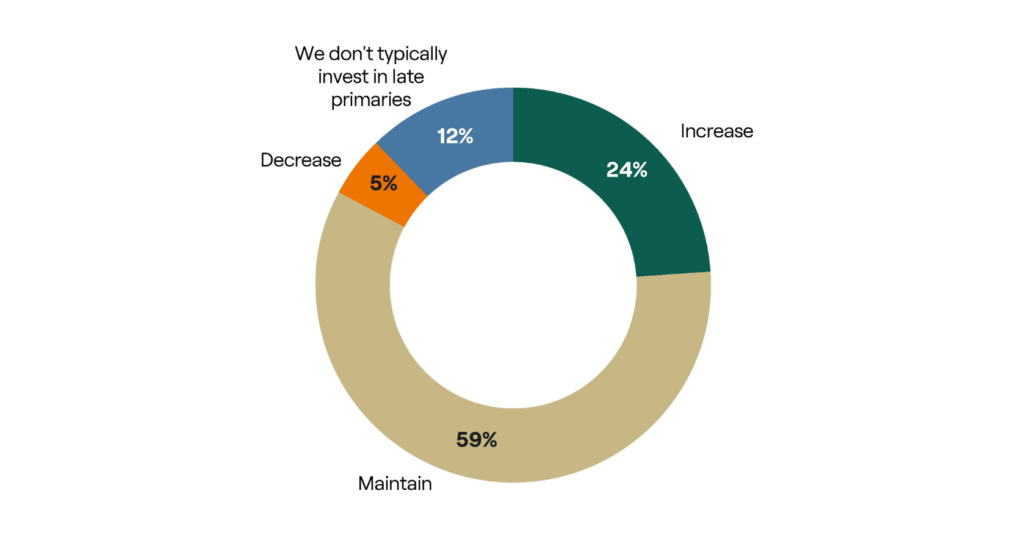

Nearly a quarter of respondents expect to increase their late primary activity, compared with two years ago, while 59% anticipate maintaining roughly the same level of engagement. Regional variations reveal particularly strong momentum in certain markets, with appetite for these commitments high in the rest of the world (RoW – markets outside of North America, Europe and Asia Pacific): 43% of these LPs plan to increase late primary investments.

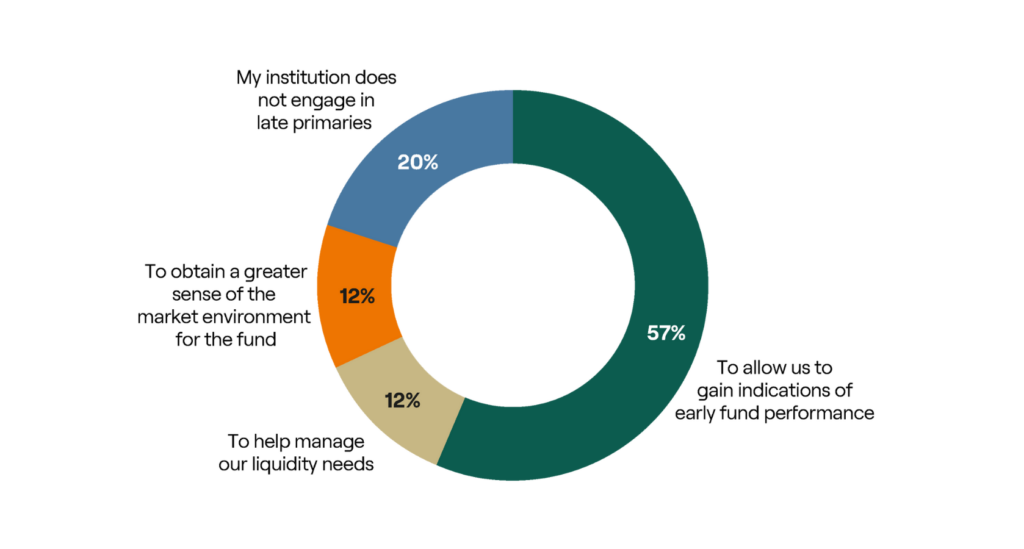

The biggest reason for LPs to make late primary investments is to see indications of early fund performance, cited by 57% of respondents, while understanding the market environment for the fund and managing liquidity are cited by 12% each. These results reflect the difficult fundraising environment, in which LPs are taking a cautious approach to new fund commitments.