LPs view co-investments as valuable for managing fees, constructing portfolios and strengthening relationships with GPs

Co-investments offer LPs the opportunity to build and reinforce relationships with GPs, reduce management fees and carried interest, and gain more control over their portfolio exposures.

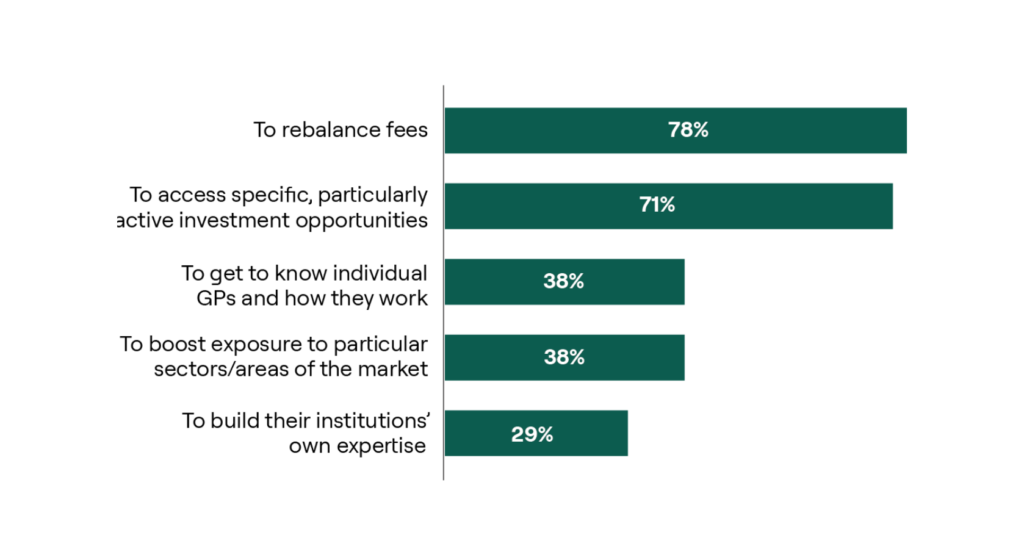

More than three-quarters of LPs say that rebalancing fees is a major reason for pursuing co-investments, followed by 71% who emphasise access to attractive investment opportunities. These findings highlight the role of co‑investments in delivering economic efficiencies and strategic value for investors.

Notably, 38% of LPs say that they use co-investments to deepen their understanding of how individual GPs work, while for 29% of respondents, they are an opportunity to build internal expertise. The latter finding suggests that some LPs view co-investments as a unique opportunity for LPs to learn alongside experienced GPs and develop investment capabilities that strengthen their entire private markets programme. North American LPs were more likely to perceive co-investments as strategic capability-building tools.

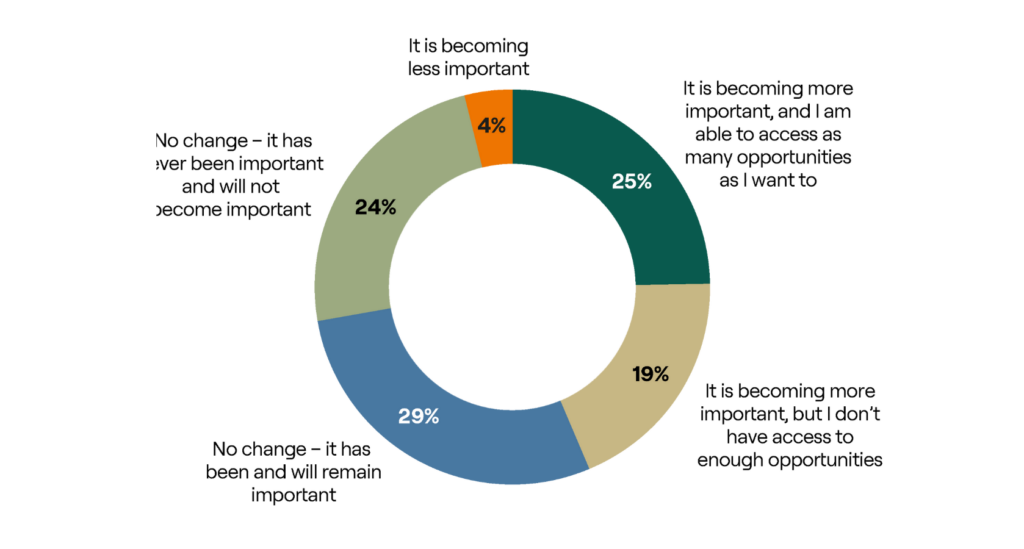

Nearly half (44%) of respondents indicate that co‑investments are becoming more important to their investment decision-making, with only 4% viewing them as less so, suggesting that access to these deals can influence which funds LPs back. However, not all LPs see as much deal flow as they would like: 19% say co-investments are increasing in importance for them, but they don’t have access to enough opportunities.

Turning to the geographic distribution of responses, APAC LPs were most positive on co-investments, with three‑quarters saying they had become more important.

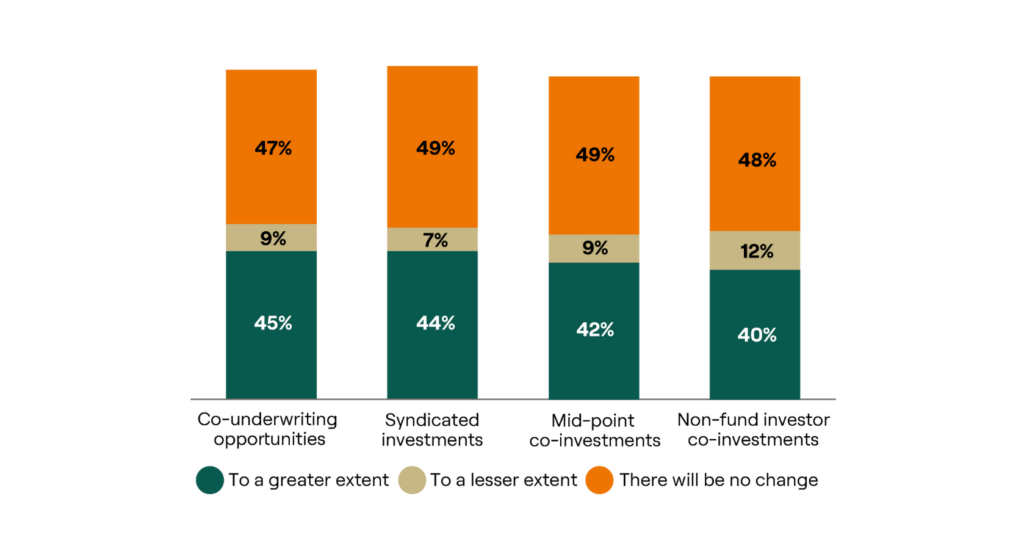

We also asked investors for their views on which types of co-investment they see as becoming more prominent in the market. Votes were evenly split, but one trend is clear: a large minority expect expansion across all co-investment types, including mid-life investments and co-underwriting transactions, to syndicated situations and co-investments alongside funds in which an LP is not an investor.

Collectively, these findings demonstrate that co‑investments have evolved from opportunistic add-ons to strategic cornerstones in LP portfolios. The combination of diverse motivations and increasing importance is indicative of a market segment experiencing healthy growth and maturity.

00:00:04 – 00:00:17

In the Winter 25-26 Barometer, we explored how surveyed LPs view...

00:00:04 – 00:00:17

In the Winter 25-26 Barometer, we explored how surveyed LPs view co-investments and the findings show they continue to grow in popularity as a strategic tool for investors in private markets portfolios.

00:00:17 – 00:00:24

More than three-quarters of LPs say that rebalancing fees are a major reason for pursuing co-investments.

00:00:24 – 00:00:32

Followed by 71% who say they take part in co-investments as they provide access to attractive investment opportunities.

00:00:32 – 00:00:38

These findings highlight the role of co-investments in delivering both economic efficiencies and strategic value.

00:00:38 – 00:00:50

Nearly half, 44% of LPs say co-investments are growing in importance as a consideration in fund investment decisions and in APAC, that number jumps to 75%.

00:00:50 – 00:00:58

However, nearly a fifth or 19% of LPs say they are not able to access as many co-investment opportunities as they would like.

00:00:58 – 00:01:06

These results reflect that co-investments have evolved from opportunistic add-ons to a core part of LP portfolios.

00:01:06 – 00:01:10

For more insights, read our full Barometer report.