Most LPs believe GPs are well resourced to manage continuation vehicles (CVs), while nearly a fifth of LPs are opting to roll into these deals

Continuation vehicles have rapidly gained acceptance as a means for GPs to hold on to their highest quality assets for longer, while offering LPs the option to roll into the new fund or to sell for liquidity.

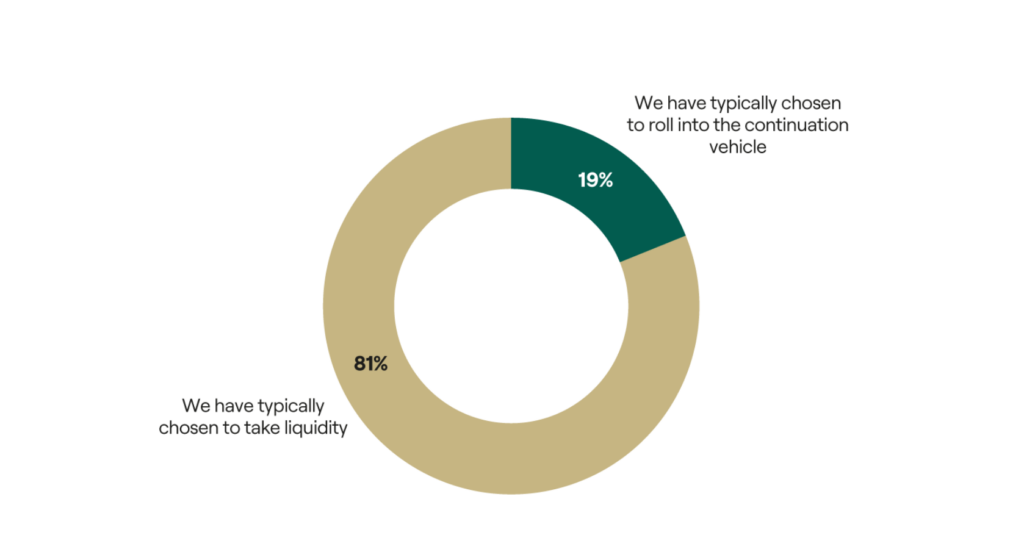

In our survey, almost one in five LPs say they typically roll their investment when presented with a CV. This suggests that, while CVs are providing an exit path and liquidity to the large majority (81%) of LPs, a reasonable minority see these transactions as offering the potential for further attractive risk‑adjusted returns.

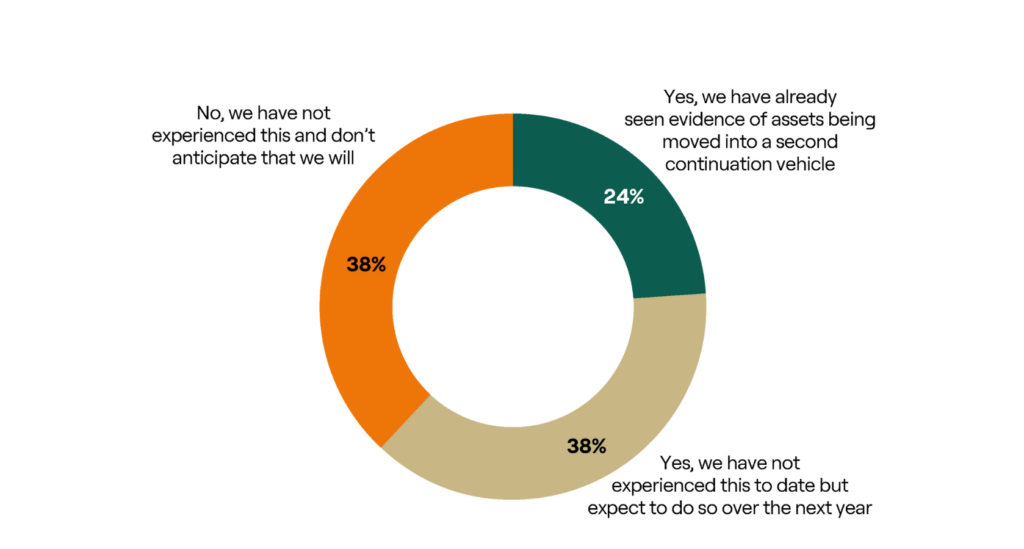

As the market develops further, we are starting to see continuation vehicles of existing continuation vehicles. LPs are also witnessing this trend, with 62% of respondents saying they have already seen, or expect to see, CVs “squared”

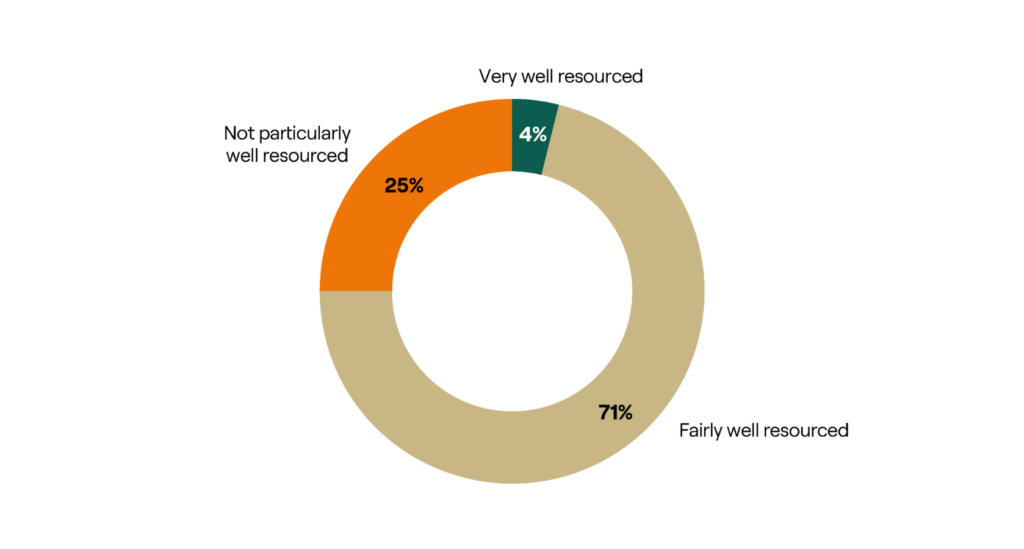

Three-quarters of LPs believe that GPs have adequate to strong resources for managing CVs. This suggests that a sizeable majority of LPs have confidence in GP operational capabilities, even in what is a relatively new and evolving market segment.

LP support is critical to these transactions and so our findings on LPs rolling and having confidence in GP resources are encouraging as this segment of the market evolves further. By providing an alternative to fixed-term fund constraints, further CV adoption could prompt an evolution in private markets towards considered and asset-specific investment horizons.

00:00:08 – 00:00:13

In our latest barometer report, we ask LPs for their views...

00:00:08 – 00:00:13

In our latest barometer report, we ask LPs for their views on continuation vehicles.

00:00:14 – 00:00:21

Almost one in five LPs surveyed in the Winter 2025 Barometer chose to roll their investment when presented with the option.

00:00:22 – 00:00:32

While CVs provide much needed liquidity to the larger majority, a reasonable minority view CVs as access to an investment opportunity with attractive risk adjusted returns.

00:00:34 – 00:00:44

Although a newer trend, three quarters of surveyed LPs believe GPs have adequate resources to manage CVs. That’s encouraging for a market that is still relatively new.

00:00:45 – 00:00:50

LP support is critical and these findings suggest CVs are well positioned for further growth.

00:00:50 – 00:00:55

As the market matures, we are seeing further evolution in the shape of CV square transactions.

00:00:56 – 00:00:58

What does that mean? It is a continuation vehicle of a continuation vehicle.

00:01:00 – 00:01:14

In fact, 62% of LPs in our survey said they’ve already seen or expect to see CV squared transactions suggesting this is a potentially meaningful new innovation that will shape the next chapter of the GP led market.

00:01:15 – 00:01:18

For more insight, read our full Barometer report.