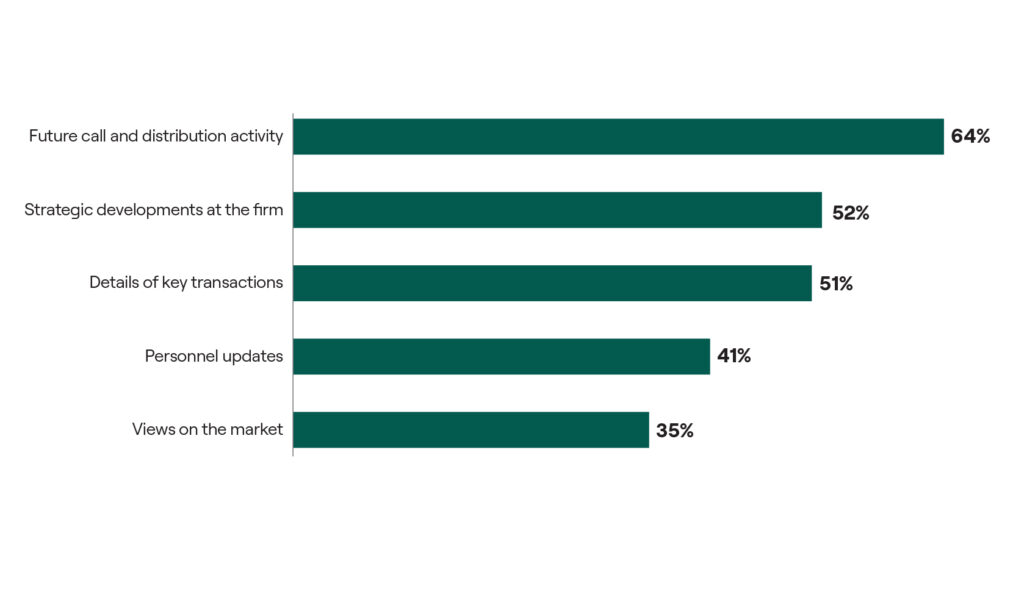

LPs would like greater transparency across future call and distribution activities

‘Future call and distribution activity’ was outlined as the area in which LPs felt GPs can introduce greater transparency. Regional views varied with European and RoW LPs expressing the strongest support for the notion, whilst North American and Asia Pacific (APAC) investors showed a greater interest in understanding ‘details of key transactions’.

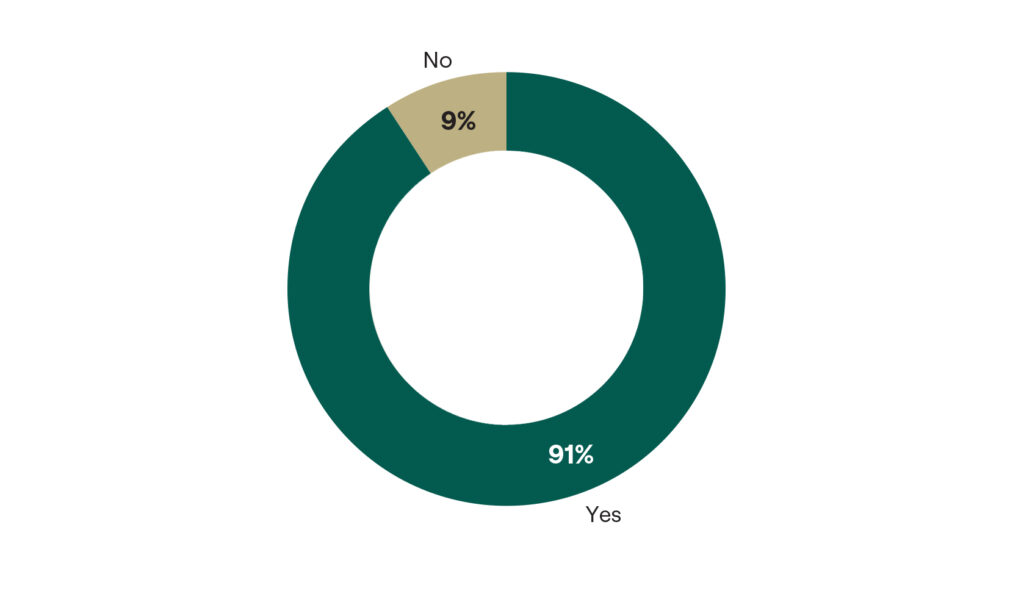

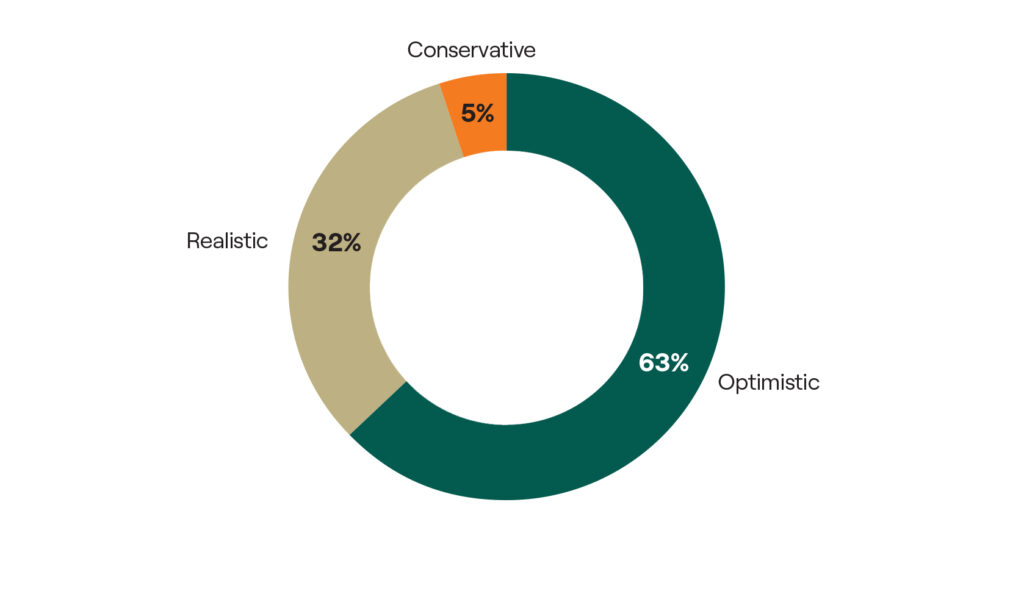

91% of LPs were supportive of introducing ‘Exit committees’ to help make decisions on exit timing and overall portfolio strategy. With 63% of investors stating that current exit timelines communicated to them by their GPs feel “optimistic”, this idea might add a further layer of objectivity to the process in the eyes of investors.

Fig 13: Overall, in which of the following areas do you feel that transparency from your GPs could be improved? (Please select all that apply)

Fig 14: Do you think it’s a good idea for GPs to have exit committees (ie. an internal group that decides on exit timing and strategy for the whole portfolio)?

Fig 15: Overall, how realistic do you feel the current exit timelines communicated to you by your GPs are?

Press contact

Looking for more information?

Get in touch

Subscribe to Coller research publications

Discover more

Related news & insights