First in secondaries

Since our founding in 1990, Coller Capital has been an innovator, focused exclusively on private capital secondary investing.

Our consistent performance has made us a partner of choice for investors, and we continue to push the boundaries of what’s possible in private capital. With a pioneering and collaborative approach, we earn the trust and recognition of our long-term partners around the world.

We are a global, close-knit team wholly focused on secondaries, and we invest with confidence and care.

|

“If we take care of our investors, our investors will take care of Coller Capital, and Coller Capital will take care of its people.That’s the Coller ethos.Jeremy Coller |

Why Coller Capital?

| . | |||

Focused |

Complete dedication to secondaries. | ||

|

|

|||

Global |

Home-grown international investment team with over 24 nationalities – global presence with a local approach. | ||

|

|

|||

Expert |

Pioneering GP-led investing since 1996, completing over 100 transactions, which total over $18bn. | ||

|

|

|||

Deal-flow |

Large volume of off-market deal-flow generated. | ||

|

|

|||

Selective |

Hyper selective in our investment approach, completing <1% of total originated. | ||

|

|

|||

Aligned |

The Coller team is the largest investor in each of our last three flagship funds. | ||

| . | |||

Who we serve

Institutions looking to invest

We are a specialist investor in the secondary private capital market, providing private equity and credit secondaries funds to institutional investors worldwide.

Private wealth investors

The characteristics of secondaries make it a well suited investment for high net worth investors looking to enter the private markets. We offer perpetual funds for US and international investors.

Investors looking for liquidity

We offer liquidity solutions to private market investors, often solving complex liquidity issues for them.

What are private capital secondaries?

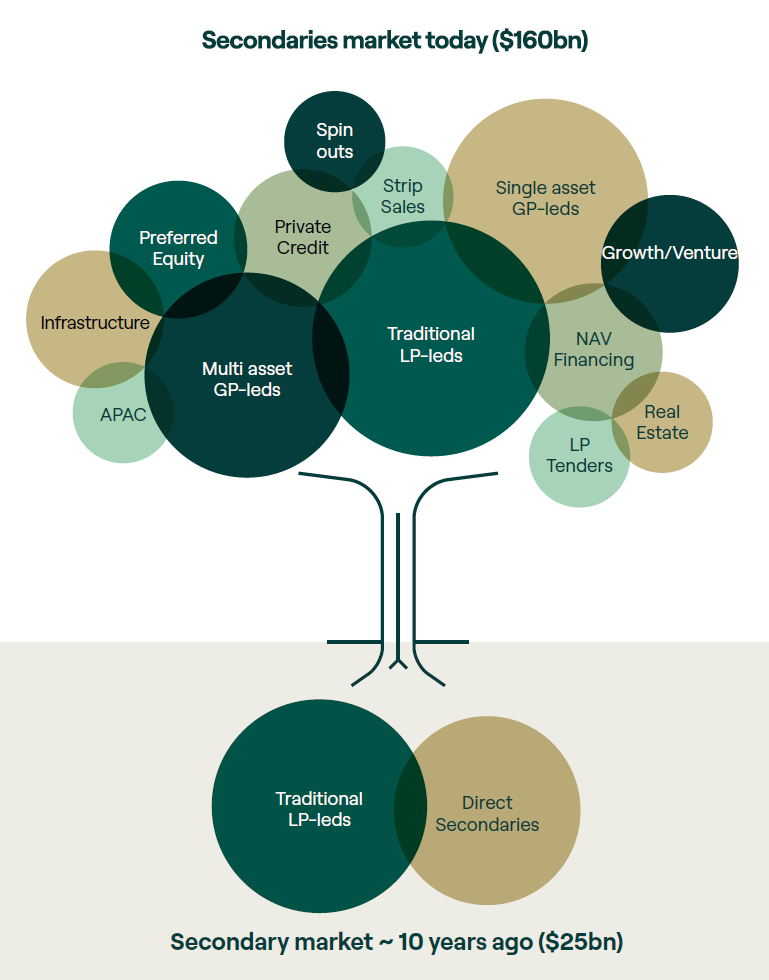

The private capital secondaries market is the only way for private market investors to exit early from their investments. It also allows fund managers to provide additional liquidity options to their investors.

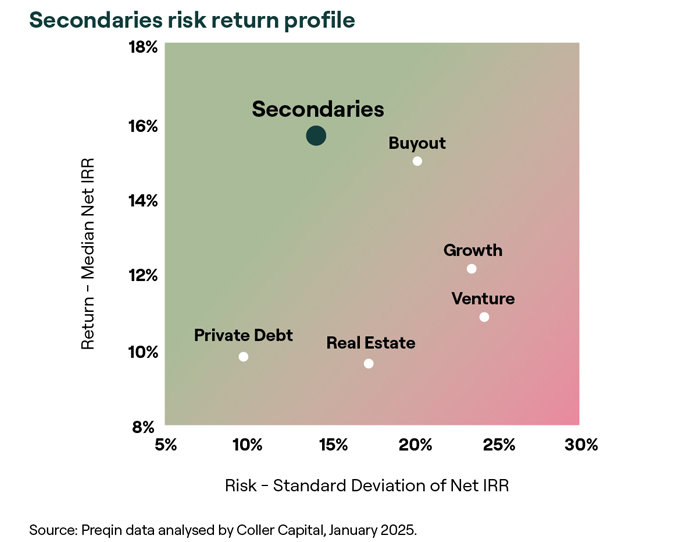

Secondaries can be an attractive option for individual investors who are looking to diversify their portfolios and potentially generate attractive risk-adjusted returns through private equity.

Secondaries funds typically contain a range of different underlying funds and strategies bringing greater diversification than you would get by investing in a primary private equity fund.

Evolution of secondary investment opportunities

Our journey

Our achievements

|

|

|

| PEW Performance of the Year (2025) | Secondaries firm of the Year (2024) | Private Credit Secondaries Fund of the Year for CCO I (2024) |

| . | ||

|

|

|

| Secondaries Investor of the Year (2024) | PEWIN 2024 International GP (Non-Female-led) award | Best Secondary Performance for funds over $1.5bn (2024) |

| . | ||

|

|

|

| Real Deals Inaugural Secondaries Award (2023) | Best Secondaries Manager (2022) | Shortlisted for the Stewardship Initiative of the Year PRI Awards (2022) |

| . | ||

|

|

|

| Winner, Excellence in Stewardship, ICGN Awards (2021) | Winner, Eco-Systems Category SIA Awards (2021) | European Secondaries Deal of the Year (four-time winner) |